HOUSTON: Oil prices fell on Tuesday as investors considered a smaller than expected increase to OPEC+ output in November against signs of a potential supply glut.

Brent crude futures were down 18 cents, or 0.27%, to $65.29 a barrel at 11:47 a.m. EDT (1547 GMT). U.S. West Texas Intermediate crude was down 13 cents, or 0.21%, to $61.56.

Both contracts settled more than 1% up in the previous session after the Organization of the Petroleum Exporting Countries plus Russia and some smaller producers, together known as OPEC+, decided to increase collective oil production by 137,000 barrels per day, starting in November.

Market sentiment remains subdued, in particular after Saudi Arabia opted to keep the official selling price of its flagship crude to Asia unchanged, defying analyst expectations for an increase, StoneX analyst Alex Hodes said in a note on Tuesday.

Oil rises after OPEC+ hikes output less than expected

The move was in contrast to market expectations for a more aggressive increase, a sign that the group remains cautious in light of predictions for a global supply surplus in the fourth quarter as well as next year, said ING analysts.

On the demand side, India’s fuel demand rose by 7% year on year in September, according to data from the Petroleum Planning and Analysis Cell of the Oil Ministry.

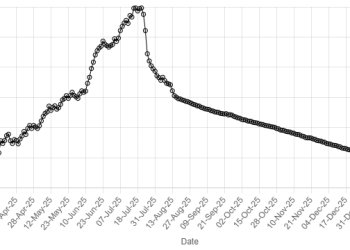

On the supply side, JPMorgan said global oil inventories, including crude stored on water, have risen every week in September, adding 123 million barrels during the month.

China, meanwhile, is building oil reserve sites at a rapid clip as part of a campaign to boost stockpiles, according to public data, traders and industry experts.

Geopolitical factors have kept a floor under prices, with conflict between Russia and Ukraine affecting energy assets and creating uncertainty over Russian crude supply.

Russia’s Kirishi oil refinery halted its most productive distillation unit after a drone attack and subsequent fire on October 4, with recovery likely to take about a month, two industry sources said on Monday.

Investors are also awaiting U.S. oil stocks data, due later on Tuesday from the American Petroleum Institute.

“Right now the market is locked in a sideways pattern, waiting to see what happens with inventories,” said Phil Flynn, a senior analyst at Price Futures Group.