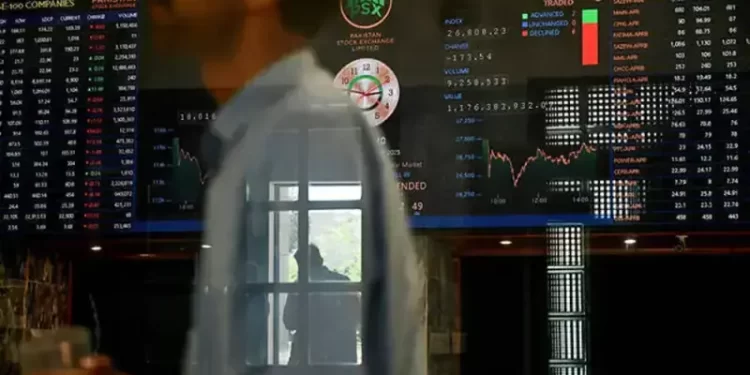

A volatile session was observed at the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 Index swinging both ways during trading on Wednesday.

The market kicked off trading on a positive note, pushing the benchmark index to an intra-day high of 166,947.19. However, profit-taking was observed during trading, dragging the KSE-100 to an intra-day low of 165,109.84.

At close, the benchmark index settled at 165,266.74, a decrease of 907 points or 0.55%.

In a key development, the World Bank revised Pakistan’s GDP growth rate projection downward by 0.5% to 2.6% for the current fiscal year 2025-26 against the earlier projection of 3.1% (June 2025). The bank said that ongoing catastrophic floods have dampened the forecast and also warned of a rise in inflation due to disruption in the food supply chain.

Pakistan posted a gross domestic product (GDP) growth of 3.04% during FY2025, estimates released by the Pakistan Bureau of Statistics (PBS) on Wednesday showed.

On Tuesday, PSX closed in the red as selling pressure dominated the session, attributed to heavy profit-taking by local institutions, which overshadowed early gains. The benchmark KSE-100 Index plunged by 1,578.66 points, or 0.94%, to finish at 166,173.75 points.

Internationally, Asian stocks tracked Wall Street lower on Wednesday as investors grappled with the fallout from political drama in France and Japan, while a prolonged US government shutdown catapulted gold spot prices to a record $4,000 per ounce level.

MSCI’s broadest index of Asia-Pacific shares outside Japan fell 1%, inching away from the 4-1/2 year high it hit on Tuesday. The Chinese and South Korea markets were closed for a long holiday.

Japan’s Nikkei rose 0.35%, just shy of the record peak touched in the previous session.

All eyes are on the Japanese markets after a surprise victory over the weekend for fiscal dove Takaichi spurred worries over the fiscal and monetary policy outlook, with traders swiftly cutting their bets on another hike this year.

Investors have had to rely on secondary, independently produced data, along with remarks from monetary policymakers, to gauge the likelihood that the Federal Reserve will implement its second rate cut of the year at this month’s policy meeting.

Traders are pricing in 45 basis points of easing this year.