The Pakistan Stock Exchange (PSX) experienced a volatile session on Tuesday, as its benchmark KSE-100 reversed gains after a positive start amid aggressive profit-taking in the final hours. The index closed the day sharply down by over 2,000 points.

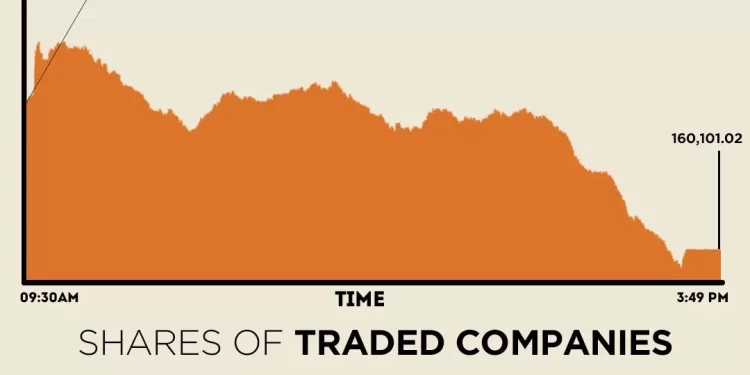

The market opened on a positive note, with the KSE-100 hitting an intra-day high of 163,380.67. However, investor sentiments shifted in the final hours of trading, dragging the index to an intra-day low of 159,805.34.

At close, the benchmark index settled at 160,101.02, a decrease of 2062.79 points or 1.27%.

“The local bourse blew hot and cold today as the KSE-100 Index witnessed a dramatic tug-of-war between the bulls and the bears. The session opened on a strong note, with the bulls marching ahead in the first half and lifting the index to an intra-day high of 1,216 points,” brokerage house Topline Securities said in its post-market report.

“However, momentum quickly faded as the bears regained control in the latter half,” it added.

“The mixed performance was largely attributed to the ongoing futures rollover week and a spate of corporate earnings announcements, which kept investors cautious and triggered profit-taking across key sectors. Market participants now look toward the upcoming results and rollover adjustments for near-term direction.”

Losses were mainly driven by HUBC, MEBL, HBL, OGDC, and UBL, collectively shaving off 585 points from the index. On the flip side, LUCK, PSEL, SRVI, BAHL, and TRG provided some support, contributing a combined 171 points to the benchmark, Topline said.

Pakistan and Saudi Arabia agreed on Tuesday to launch an Economic Cooperation Framework between the two countries.

The framework is based on the two countries’ shared economic interests and reaffirms their mutual desire to strengthen trade and investment relations to serve their common interests, according to a statement from the Prime Minister’s House.

However, talks between Pakistan and Afghanistan in Istanbul to broker a long-term truce ended without a resolution, two sources familiar with the matter told Reuters on Tuesday.

The Monetary Policy Committee (MPC) on Monday decided to keep the policy rate unchanged at 11%. The committee noted that headline inflation rose significantly to 5.6% in September, whereas core inflation remained unchanged at 7.3%.

“The MPC assessed that the impact of the recent floods on the broader economy appears to be somewhat lower than anticipated at the time of its previous meeting,” read the statement.

Meanwhile, the International Monetary Fund (IMF) is expected to hold its board meeting by December 2025 to approve the release of the next $1.2 billion tranche to Pakistan.

On Monday, PSX began the rollover week on a bearish note as widespread selling pressure, profit-taking, and cautious investor sentiment drove the index sharply lower. The benchmark KSE-100 Index fell by 1,140.32 points, or 0.7%, to close at 162,163.81 points.

Internationally, Asian shares consolidated recent hefty gains on Tuesday as hopes for an easing in global trade tensions kept risk appetites keen, while the bull run in tech stocks counted on a bumper round of big-cap earnings this week.

The likelihood of lower borrowing costs in the United States and Canada this week supported bonds, while the dollar paused to see just how dovish the Federal Reserve might be on the outlook.

Meanwhile, safe-haven gold huddled around $4,000 an ounce, as a drop of 9% in five sessions squeezed leveraged money out of a very crowded trade.

Several Asian share markets have also hit all-time highs and were overdue for a breather.

The Nikkei eased 0.2%, having surged 2.5% on Monday as a rally in all things tech lifted it to gains of almost 27% so far this year.

Japan’s new Prime Minister Sanae Takaichi met U.S. President Donald Trump in Tokyo to discuss defence ties, trade and a package of U.S. investments in a $550 billion deal struck earlier this year.

South Korean stocks slipped 1.4%, giving back just some of Monday’s 2.6% jump. Sentiment was aided by data showing the economy outpaced forecasts in the third quarter, led by strength in consumption and exports.

MSCI’s broadest index of Asia-Pacific shares outside Japan edged down 0.1%, while Chinese blue chips were little changed.

Pakistan rupee hit nearly 6-month high in the inter-bank market on Tuesday, helped by its months long gradual appreciation against the US dollar. The local currency has recorded gains against the greenback for the last many weeks, remaining in per-day range of a few paise.

Volume on the all-share index increased to 1,019 million from 1,007 million recorded in the previous close. The value of shares rose to Rs36.94 billion from Rs34.82 billion in the previous session.

K-Electric Ltd was the volume leader with 94.59 million shares, followed by WorldCall Telecom with 83.31 million shares, and B.O.Punjab with 60.38 million shares.

Shares of 476 companies were traded on Tuesday, of which 113 registered an increase, 324 recorded a fall, and 39 remained unchanged.