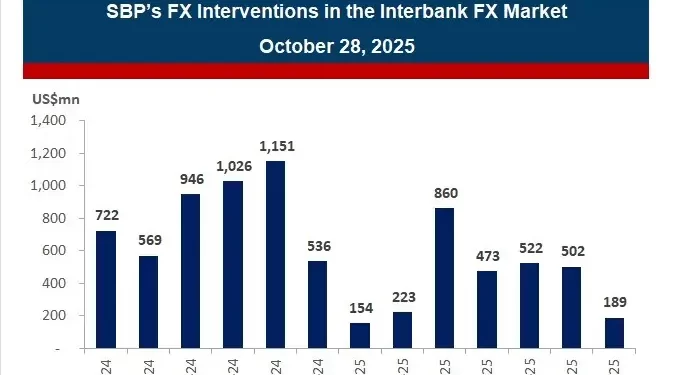

KARACHI: Pakistan’s central bank slowed down the purchase of US dollars to five-month low at $189 million from the inter-bank market in July 2025, summing up the cumulative purchases worth $7.15 billion in 12 months (August 2024–July 2025), brokerage house Topline Securities reported on Tuesday, citing the State Bank of Pakistan’s (SBP) data.

The central bank reports the US dollars’ purchase data with a lag of three month.

The slowdown in the month of July was witnessed apparently in the wake of low supply of the foreign currency and/or low demand for import payment and foreign debt repayment in the month, according to analysts.

Banks to offer collateral-free financing of up to Rs1mn to small farmers: SBP

Saad Hanif, Head of Research at Ismail Iqbal Securities, said the cumulative purchases worth $7.15 billion in 12 months helped the State Bank of Pakistan (SBP) to stabilise the rupee against the US dollar and boosted the country’s foreign exchange (FX) reserves (held by the SBP).

The buying also helped the central bank smoothly repay foreign debt on time without increasing the total tally of foreign loans and yet managing current account deficit at moderate level in the ongoing fiscal year 2025-26.

The central bank’s purchases of the greenback partly helped the SBP’s foreign exchange reserves boost by $5.15 billion in the 12 months (August 2024 to July 2025), rising to $14.30 billion at the end of July 2025 from $9.15 billion at the outset of August 2024, according to the central bank data.

The FX reserves stood at $14.45 billion on October 17, 2025, according to the latest weekly update by the SBP.

A significant growth in inflows of workers’ remittances helped boosting supply of the US dollar in inter-bank market, convincing the central bank to absorb surplus supply of the greenback.

SBP reported the workers’ remittances rose by 26.6% to $38.3 billion in FY25 compared to $30.3 billion in FY24.

Hanif said the central bank had slowed down buying of the greenback apparently in the wake of low demand for the foreign currency, as the bank was having moderate debt obligations in July – the first month of FY26.

“Pakistan was having a total debt repayments and interest payments summing up at around $26 billion for FY26. A large part of that was to be rolled over, making the cash-settled repayments affordable for the nation,” he said.

The central bank’s low purchase of the greenback in July coincided with the rupee facing increasing pressure against US dollar in the first two to three weeks of the month.

The data suggested the Pakistani currency had depreciated to Rs284.97/$ by July 17, 2025 compared to Rs283.76/$ on June 30, 2025 – losing almost Re1 in the three weeks. Later on, the currency recovered to Rs282.87/$ on July 31, 2025 – regaining Rs2.10/$ in the last 10 day of July.

The rupee hit six-month high at Rs280.97/$ on Tuesday compared to Rs281.01/$ on Monday – up by 0.01% on day-to-day basis, according to the SBP.

American Dollar Exchange Rate

American Dollar Exchange Rate