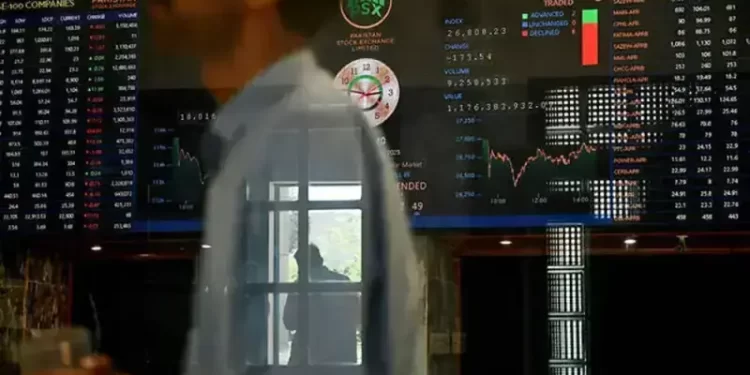

The Pakistan Stock Exchange (PSX) observed a mild downturn during intraday trading on Tuesday, with the benchmark KSE-100 Index shedding nearly 700 points.

The market opened on a positive note but quickly lost momentum, with the index moving between an intraday high of 163,384.95 and a low of 161,924.57.

At 12:20pm, the benchmark index was hovering at 162,126.39, a decrease of 676.76 points or 0.42%.

Selling pressure was observed in key sectors, including automobile assemblers, cement, commercial banks, oil and gas exploration companies, OMCs and power generation. Index-heavy stocks, including HUBCO, MARI, OGDC, PPL, POL, POL, MEBL and MCB, traded in the red.

In a key development, Federal Board of Revenue (FBR) Chairman Rashid Mahmood Langrial ruled out any contingency plan in terms of implementing new taxation measures despite a revenue shortfall of Rs 275 billion during the July-October (2025-26) period.

On Monday, PSX started the week on a strong note, supported by the positive momentum carried over from Friday’s session and improved regional sentiment following last week’s Pakistan–Afghanistan ceasefire. The benchmark KSE-100 index advanced by 1,171.42 points, or 0.72%, to close at 162,803.16 points.

Internationally, a rise in tech shares lifted Japan’s Nikkei and Taiwan’s TAIEX to all-time highs on Tuesday, though other markets in the region were lower following their own recent record rallies.

Sentiment was saddled with some weakness in US economic data, while a divergence in views from Federal Reserve officials clouded the outlook for a December interest rate cut.

Australia’s stock benchmark sagged to a one-month trough ahead of a central bank policy decision later in the day, with no rate cut expected and traders on the lookout for clues about whether last month’s inflation shock has nixed any easing until the second quarter of next year.

Overnight, tech shares buoyed both the US S&P 500 and Nasdaq, though futures pointed to declines of 0.3% and 0.5%, respectively.

Japan’s Nikkei reversed early declines to rise 0.2% and reach an unprecedented 52,636.87.

Taiwan’s TAIEX gained 0.5% to set its own record high.

However, South Korea’s KOSPI slid 1.5% after Monday’s 2.8% surge when it reached an all-time peak.

Hong Kong’s Hang Seng added 0.1%, while Chinese blue chips listed onshore eased 0.1%.

Australia’s stock benchmarklost 0.8%.

This is an intra-day update