Selling pressure returned to the Pakistan Stock Exchange (PSX) on Tuesday, with the benchmark KSE-100 index shedding over 1,500 points amid profit-taking.

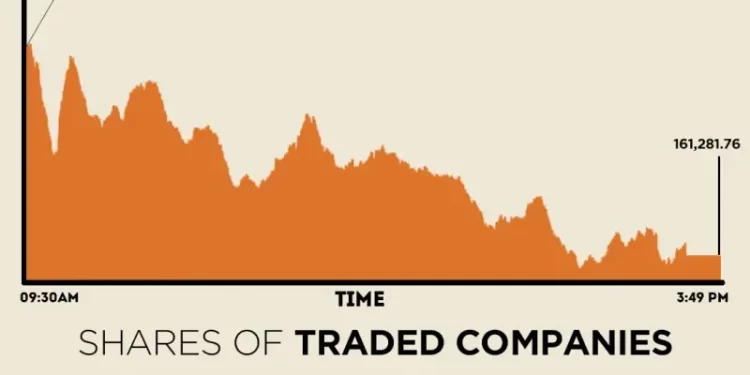

The market opened on a positive note but quickly lost momentum, with the index moving between an intraday high of 163,384.95 and a low of 161,159.26.

At close, the benchmark index settled at 161,281.77, a decrease of 1,521.39 points or 0.93%.

“After two consecutive sessions of strong gains, the local bourse witnessed renewed bearish sentiment as investors opted for profit-taking,” said Topline Securities.

Blue-chip counters, including ENGRO, MARI, BAHL, MCB, and TRG, led the decline, collectively eroding 543 points from the benchmark index, it added.

In a key development, Federal Board of Revenue (FBR) Chairman Rashid Mahmood Langrial ruled out any contingency plan in terms of implementing new taxation measures despite a revenue shortfall of Rs 275 billion during the July-October (2025-26) period.

On Monday, PSX started the week on a strong note, supported by the positive momentum carried over from Friday’s session and improved regional sentiment following last week’s Pakistan–Afghanistan ceasefire. The benchmark KSE-100 index advanced by 1,171.42 points, or 0.72%, to close at 162,803.16 points.

Internationally, a rise in tech shares lifted Japan’s Nikkei and Taiwan’s TAIEX to all-time highs on Tuesday, though other markets in the region were lower following their own recent record rallies.

Sentiment was saddled with some weakness in US economic data, while a divergence in views from Federal Reserve officials clouded the outlook for a December interest rate cut.

Australia’s stock benchmark sagged to a one-month trough ahead of a central bank policy decision later in the day, with no rate cut expected and traders on the lookout for clues about whether last month’s inflation shock has nixed any easing until the second quarter of next year.

Overnight, tech shares buoyed both the US S&P 500 and Nasdaq, though futures pointed to declines of 0.3% and 0.5%, respectively.

Japan’s Nikkei reversed early declines to rise 0.2% and reach an unprecedented 52,636.87.

Taiwan’s TAIEX gained 0.5% to set its own record high.

However, South Korea’s KOSPI slid 1.5% after Monday’s 2.8% surge when it reached an all-time peak.

Hong Kong’s Hang Seng added 0.1%, while Chinese blue chips listed onshore eased 0.1%.

Meanwhile, the Pakistani rupee registered marginal improvement against the US dollar in the inter-bank market on Tuesday. At close, the currency settled at 280.87, a gain of Re0.03 against the greenback.

Volume on the all-share index decreased to 899.41 million from 949.36 million recorded in the previous close. The value of shares declined to Rs37.31 billion from Rs47.58 billion in the previous session.

WorldCall Telecom was the volume leader with 78.87 million shares, followed by Telecard Limited with 76.86 million shares, and K-Electric Ltd with 71.62 million shares.

Shares of 479 companies were traded on Tuesday, of which 133 registered an increase, 314 recorded a fall, and 32 remained unchanged.