Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”, “05-May-25”, “06-May-25”, “07-May-25”, “08-May-25”, “09-May-25”, “12-May-25”, “13-May-25”, “14-May-25”, “15-May-25”, “16-May-25”, “19-May-25”, “20-May-25”, “21-May-25”, “22-May-25”, “23-May-25”, “26-May-25”, “27-May-25”, “29-May-25”, “30-May-25”, “02-Jun-25”, “03-Jun-25”, “04-Jun-25”, “05-Jun-25”, “10-Jun-25”, “11-Jun-25”, “12-Jun-25”, “13-Jun-25”, “16-Jun-25”, “17-Jun-25”, “18-Jun-25”, “19-Jun-25”, “20-Jun-25”, “23-Jun-25”, “24-Jun-25”, “25-Jun-25”, “26-Jun-25”, “27-Jun-25”, “30-Jun-25”, “02-Jul-25”, “03-Jul-25”, “04-Jul-25”, “07-Jul-25”, “08-Jul-25”, “09-Jul-25”, “10-Jul-25”, “11-Jul-25”, “14-Jul-25”, “15-Jul-25”, “16-Jul-25”, “17-Jul-25”, “18-Jul-25”, “21-Jul-25”, “22-Jul-25”, “23-Jul-25”, “24-Jul-25”, “25-Jul-25”, “28-Jul-25”, “29-Jul-25”, “30-Jul-25”, “31-Jul-25”, “01-Aug-25”, “04-Aug-25”, “05-Aug-25”, “06-Aug-25”, “07-Aug-25”, “08-Aug-25”, “11-Aug-25”, “12-Aug-25”, “13-Aug-25”, “15-Aug-25”, “18-Aug-25”, “19-Aug-25”, “20-Aug-25”, “21-Aug-25”, “22-Aug-25”, “25-Aug-25”, “26-Aug-25”, “27-Aug-25”, “28-Aug-25”, “29-Aug-25”, “01-Sep-25”, “02-Sep-25”, “03-Sep-25”, “04-Sep-25”, “05-Sep-25”, “08-Sep-25”, “09-Sep-25”, “10-Sep-25”, “11-Sep-25”, “12-Sep-25”, “15-Sep-25”, “16-Sep-25”, “17-Sep-25”, “18-Sep-25”, “19-Sep-25”, “21-Sep-25”, “22-Sep-25”, “23-Sep-25”, “24-Sep-25”, “25-Sep-25”, “26-Sep-25”, “29-Sep-25”, “30-Sep-25”, “01-Oct-25”, “02-Oct-25”, “03-Oct-25”, “06-Oct-25”, “07-Oct-25”, “08-Oct-25”, “09-Oct-25”, “10-Oct-25”, “13-Oct-25”, “14-Oct-25”, “15-Oct-25”, “16-Oct-25”, “17-Oct-25”, “20-Oct-25”, “21-Oct-25”, “22-Oct-25”, “23-Oct-25”, “24-Oct-25”, “27-Oct-25”, “28-Oct-25”, “29-Oct-25”, “30-Oct-25”, “31-Oct-25”, “03-Nov-25”, “04-Nov-25”, “05-Nov-25”, “06-Nov-25”, “07-Nov-25”, “10-Nov-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06, 281.22, 281.37, 281.47, 281.52, 281.71, 281.57, 281.67, 281.72, 281.61, 281.66, 281.77, 281.92, 281.97, 282.06, 281.97, 282.06, 282.17, 282.07, 282.02, 281.97, 282.12, 282.22, 282.17, 282.21, 282.47, 282.67, 282.96, 283.17, 283.41, 283.55, 283.64, 283.70, 283.87, 283.77, 283.72, 283.67, 283.72, 283.76, 283.95, 283.86, 283.97, 284.22, 284.36, 284.47, 284.56, 284.46, 284.72, 284.67, 284.96, 284.97, 284.87, 284.95, 284.97, 284.76, 284.22, 283.45, 283.21, 283.05, 282.95, 282.87, 282.72, 282.66, 282.57, 282.67, 282.56, 282.47, 282.45, 282.42, 282.22, 282.06, 282.01, 281.96, 281.95, 281.92, 281.90, 281.87, 281.86, 281.83, 281.8, 281.77, 281.75, 281.72, 281.71, 281.67, 281.65, 281.62, 281.61, 281.60, 281.56, 281.55, 281.52, 281.51, 281.50, 281.47, 281.46, 281.45, 281.46, 281.42, 281.43, 281.41, 281.37, 281.35, 281.32, 281.31, 281.27, 281.26, 281.25, 281.22, 281.21, 281.20, 281.17, 281.16, 281.15, 281.12, 281.11, 281.10, 281.07, 281.06, 281.05, 281.03, 281.02, 281.01, 280.97, 280.96, 280.92, 280.91, 280.90, 280.87, 280.86, 280.85, 280.82, 280.81

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

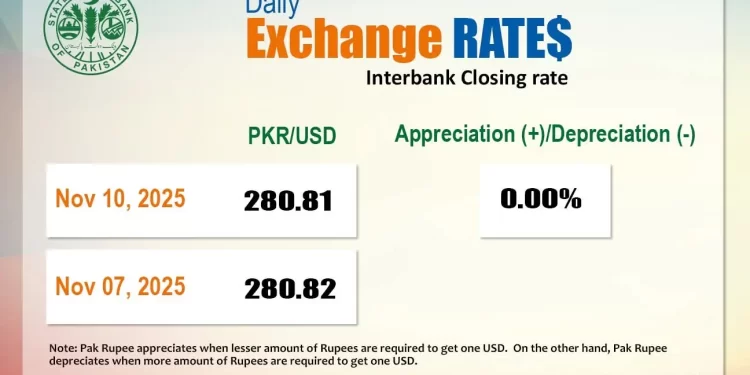

The Pakistani rupee registered marginal gain against the US dollar in the inter-bank market on Monday.

At close, the currency settled at 280.81, a gain of Re0.01 against the greenback.

During the previous week, the Pakistani rupee posted marginal gain as it appreciated by Re0.09 or 0.03% against the US dollar in the inter-bank market. The local unit closed at 280.82, against 280.91 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar softened on Monday as signs that the federal government could soon reopen buoyed investor confidence after a string of weak economic data.

The dollar index, which tracks the greenback’s strength against a basket of six major currencies, slid 0.1% to 99.643 after the Senate voted to advance a measure that could fund the US government through January.

On prediction market Polymarket, the implied probability that the shutdown would end before November 15 surged to 92%.

Against the yen, the dollar appreciated 0.2% to 153.80 yen , following comments from Japanese Prime Minister Sanae Takaichi on Monday that she would work on setting a new fiscal target extending through several years to allow more flexible spending, essentially watering down the country’s commitment to fiscal consolidation.

Traders are assessing the impact of US President Donald Trump’s economic policies, which had sparked a rush of production earlier in the year ahead of a US deadline to implement tariffs on foreign imports.

The euro was 0.1% weaker at $1.1559, while sterling changed hands at $1.3148 , 0.1% softer on the day.

The offshore yuan was at 7.1204 against the dollar, unchanged in Asian trading.

Oil prices, a key indicator of currency parity, edged higher on Monday as investors assessed a potential end to the US government shutdown and concerns around oversupply in the crude market.

Brent crude futures rose 31 cents, or 0.49%, to $63.94 a barrel by 1300 GMT. US West Texas Intermediate crude was at $60.05 a barrel, up 30 cents, or 0.5%.

Inter-bank market rates for dollar on Monday

BID Rs 280.81

OFFER Rs 281.00

Open-market movement

In the open market, the PKR lost 4 paise for buying and remained unchanged for selling against USD, closing at 281.35 and 281.85, respectively.

Against Euro, the PKR lost 45 paise for buying and 32 paise for selling, closing at 324.54 and 327.73, respectively.

Against UAE Dirham, the PKR gained 6 paise for buying and 4 paise for selling, closing at 76.61 and 77.40, respectively.

Against Saudi Riyal, the PKR gained 1 paisa for buying and remained unchanged for selling, closing at 74.95 and 75.59, respectively.

Open-market rates for dollar on Monday

BID Rs 281.35

OFFER Rs 281.85