MUMBAI: Indian government bonds fell on Thursday, as cautious traders pared positions ahead of the weekly debt supply, while concerns over sticky core inflation and reduced purchases from a key investment category that includes the central bank lingered.

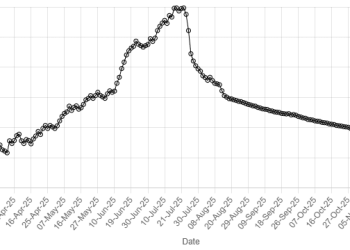

The yield on the benchmark 10-year note settled at 6.5161%, compared with Wednesday’s close of 6.4955%. Bond yields rise when prices fall.

The Reserve Bank of India is set to sell bonds worth 280 billion rupees ($3.16 billion) on Friday, including a 15-year and a 40-year note.

The auction’s outcome will be closely watched, particularly as demand for long-term bonds appears to be dwindling, traders said.

Market sentiment has already weakened after the so-called ‘others’ category, which includes the RBI along with some long-term investors, net bought bonds worth 13.8 billion rupees ($155 million) on Wednesday, its lowest single-day purchase so far in November.

This was a sharp drop from the daily average of 50 billion rupees in the previous six sessions, data from the Clearing Corporation of India showed.

The fall in suspected RBI purchases, along with a higher-than-expected October core inflation of 4.4%, has driven the 10-year yield above the crucial level of 6.50%.

Rate cut bets have also wavered as a potential trade deal with the United States can lessen the tariff burden on growth and reduce the urgency for the RBI to cut rates.

“The mix of inflation undershoot and growth overshoot complicates the case for a cut in December,” strategists at Nomura said in a note.

The cut in December is a “close call,” they said, adding that they are still betting on a 50-basis-point cut over the course of December and February meetings.

RATES

India’s overnight index swap rates ended steady on Thursday, with traders cautiously eyeing strong directional cues.

The one-year OIS was flat at 5.46%, while the two-year rate was steady at 5.44%.

The liquid five-year swap rate was little changed at 5.7050%.