After days of buying momentum, selling pressure returned to the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 Index closing with a loss of over 800 points on Friday.

After a relatively uneventful trading session during the first half, selling was observed at the bourse during the final hours of trading.

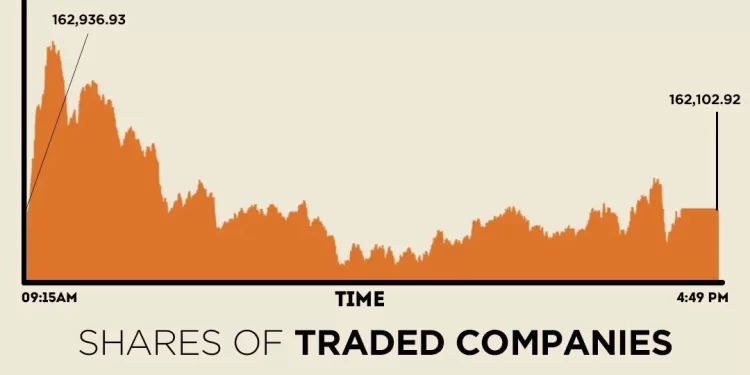

At close, the benchmark index settled at 162,102.92, a decrease of 834 points or 0.51%.

On Thursday, the PSX witnessed a broadly positive trading session, with all major indices closing higher and the overall market capitalisation posting a noticeable rise.

The KSE-100 gained 710.66 points, or 0.44%, to close at 162,936.94.

Internationally, Asian shares extended a global rout on Friday as the much-anticipated US jobs data failed to provide clarity on the near-term path for interest rates, with investors returning to dumping risk assets even after Nvidia’s earnings dazzled.

Wall Street dived overnight as jitters over inflated tech stock prices returned, resulting in the Nasdaq’s widest one-day swing since April 9, when President Donald Trump’s “Liberation Day” tariffs spooked markets.

Data showed the US economy added far more jobs than expected in September, but a rise in the unemployment rate and downward revisions to prior months painted an ambiguous picture for the Federal Reserve as it considers whether or not to cut interest rates next month.

Treasury yields fell as futures moved to imply a 40% probability of a US rate cut in December, up from 30% a day earlier, but with the next payrolls numbers available only after the Fed meeting, investors remained unconvinced of an easing next month.

On Friday, MSCI’s broadest index of Asia-Pacific shares outside Japan tumbled 1.8% to bring its weekly loss to 3%, the biggest since early April. Japan’s Nikkei fell 1.8% and was down 2.8% for the week.

Meanwhile, the Pakistani rupee recorded marginal improvement against the US dollar, appreciating 0.01% in the inter-bank market on Friday. At close, the currency settled at 280.62, a gain of Re0.03 against the greenback.

Volume on the all-share index increased to 768.05 million from 725.87 million recorded in the previous close. The value of shares declined to Rs28.64 billion from Rs35.32 billion in the previous session.

WorldCall Telecom was the volume leader with 76.71 million shares, followed by K-Electric Ltd with 64.28 million shares, and Bank Makramah with 61.38 million shares.

Shares of 476 companies were traded on Friday, of which 145 registered an increase, 289 recorded a fall, and 42 remained unchanged.