A volatile session was observed at the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 oscillating both ways to settle with a marginal loss of over 100 points on Monday.

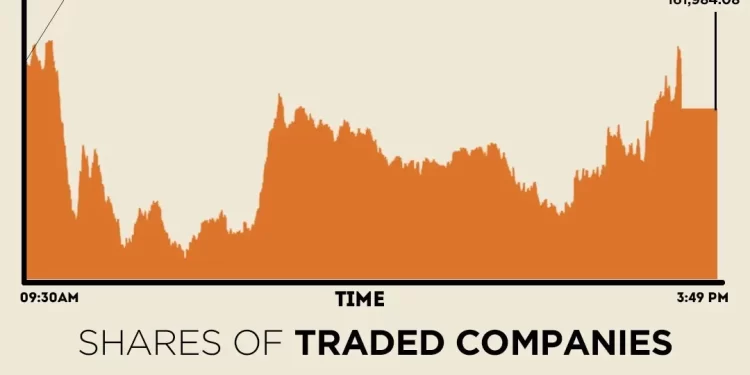

Trading kicked off on a positive note, pushing the KSE-100 to an intra-day high of 162,385.32. However, selling pressure soon returned, and by midday the benchmark index dropped to an intra-day low of 161,241.46.

At close, the benchmark index settled at 161,984.08, a decrease of 118.84 points or 0.07%.

“The local bourse remained largely range-bound throughout the session as investors maintained a cautious posture amid the expiry of November futures contracts,” brokerage house Topline Securities said in its post-market report.

“Market sentiment was further dampened by concerns surrounding the law-and-order situation in Peshawar, which exerted downward pressure on the index during the initial hours of trade. Nevertheless, selective buying in the latter part of the session helped stabilise the benchmark at 161,984.”

Key heavyweights – FFC, ENGRO, PIOC, BAHL, and HBL – drove the market upward, collectively contributing 499 points to the index. In contrast, MARI, OGDC, MEBL, POL, and PPL emerged as the leading decliners, cumulatively subtracting 347 points, Topline said.

During the previous week, the KSE-100 Index largely held its ground despite sharp fluctuations in macroeconomic indicators and a significant rise in trading activity. The benchmark closed the week at 162,102.92 points, reflecting a nominal gain of 0.1%.

The muted index performance came even as investor participation surged, suggesting a market in consolidation amid heavy turnover.

Global stocks began an event-filled week on the front foot on Monday, as investors took heart from growing expectations of a Federal Reserve rate cut in December even as policymakers remain divided over such a move.

Markets were gearing up for potential catalysts, including the release of U.S. retail sales and producer prices data due later in the week, while British finance minister Rachel Reeves is also set to unveil her highly anticipated budget.

Geopolitical developments were also front and centre of trading rooms, after the United States and Ukraine said they had created an “updated and refined peace framework” to end the war with Russia, keeping pressure on oil prices on hopes of a potential supply boost.

After a rough ride for global equity markets last week, driven in part by worries over lofty tech valuations, Monday’s session in Asia gave stocks some much-needed reprieve.

Trading was thinned with Japan markets closed for a holiday, but MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.4% and South Korea’s tech-heavy Kospi index was up 0.7%.

Nasdaq futures and S&P 500 futures rose 0.64% and 0.45%, respectively, while EUROSTOXX 50 futures advanced 0.78%.

Meanwhile, the Pakistani rupee recorded marginal improvement against the US dollar in the inter-bank market on Monday. At close, the currency settled at 280.61, a gain of Re0.01 against the greenback.

Volume on the all-share index decreased to 490.35 million from 768.05 million recorded in the previous close. The value of shares declined to Rs23.67 billion from Rs28.64 billion in the previous session.

PIA Holding Company was the volume leader with 63.29 million shares, followed by Beco Steel Ltd with 34.92 million shares, and Bank Makramah with 32.81 million shares.

Shares of 477 companies were traded on Monday, of which 191 registered an increase, 247 recorded a fall, and 39 remained unchanged.