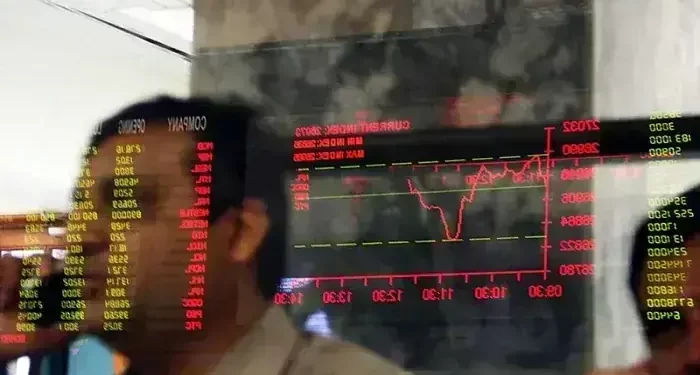

Buying rally continued at the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 Index gaining over 600 points during the opening minutes of trading on Thursday.

At 9:40am, the benchmark index was hovering at 163,796.25, an increase of 607.72 points or 0.37%.

Across-the-board buying was observed in key sectors, including automobile assemblers, cement, commercial banks, oil and gas exploration companies, OMCs, power generation and refinery. Index-heavy stocks, including ARL, MARI, OGDC, POL, PPL, PSO, HBL, MCB, MEBL and UBL, traded in the green.

Speaking at the Pakistan Business Council’s Dialogue on the Economy 2025, Muhammad Aurangzeb on Wednesday projected 3.5% economic growth for Pakistan this year, with a 4% growth forecast over the next two to three years and potential for 6-7% growth in the medium term, contingent on sustained progress in agriculture, manufacturing and services.

On Wednesday, PSX closed on a firm note as strong institutional buying in heavyweight stocks lifted all major indices despite lingering caution across the broader market. The benchmark KSE-100 Index surged by 1,496.04 points, or 0.93%, to close at 163,188.53.

Globally, Asian stocks rose on Thursday, and the dollar was soft on growing expectations of an interest rate cut from the Federal Reserve next month, while the yen remained on intervention watch, with traders weighing the prospect of a rate hike before year-end.

A holiday-curtailed week has led to limited moves across markets, with stocks keeping a largely upbeat tone and currencies much more sedate as investors shrug off AI bubble worries that had roiled equities earlier in November.

The US markets are closed for the Thanksgiving holiday on Thursday and are due to trade for a short session on Friday.

MSCI’s broadest index of Asia-Pacific shares outside Japan was 0.4% higher, tracking gains from Wall Street and on course to snap a three-week losing streak. Japan’s Nikkei and South Korea’s Kospi surged over 1%.

This is an intra-day update