ISLAMABAD: The Supreme Court directed the Private Power and Infrastructure Board (PPIB) to return the performance guarantee (PG) along with interest to Spencer Powergen Company of Pakistan Limited.

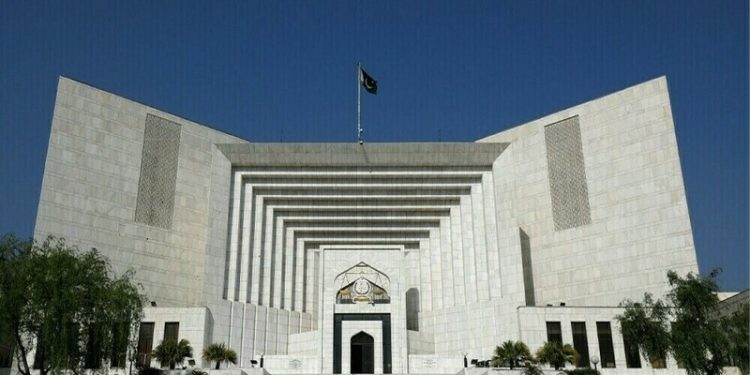

A three-member bench, headed by Justice Munib Akhtar and comprising Justice Muhammad Shafi Siddiqui and Justice Miangul Hassan Aurangzeb, upheld the Islamabad High Court (IHC) judgment.

On May 13, 2013, a Division Bench of the IHC had directed the appellants (PPIB and others) to refund the amount received on the encashment of the PG furnished by the respondent (the company), along with profit at the prevailing bank rate from the date of its encashment — November 28, 1996 — until refund.

In March 1994, the federal government had issued the policy framework and package of incentives for private sector power generation projects in Pakistan. The respondent, with the objective of setting up a 330-megawatt (MW) single-cycle thermal power generation plant based on residual furnace oil at the Sindh Industrial Trading Estate, North Karachi, applied to the PPIB for the issuance of a Letter of Interest (LOI), which was issued on September 25, 1994. The project was to be implemented on a fast-track basis and commissioned by August 1995.

The respondent was required to furnish a PG amounting to Rs100,000 per MW, to be issued by a scheduled bank licensed to operate in Pakistan.

The financial close for the project was required to be achieved within six months from the date of issuance of the Letter of Support (LOS). Clause (J) of the LOS provided that it would automatically terminate six months from the date of issuance unless extended in writing by the federal government through the PPIB. Documents on record show that the validity of the LOS was extended to October 30, 1996.

In 1996, several sponsors of private power projects held Letters of Support for a cumulative generation capacity exceeding the projected national demand for electricity. The government feared that if all these projects achieved financial close within the validity period of their respective Letters of Support, the country would face a surplus of electricity. Therefore, on March 3, 1996, the Economic Coordination Committee of the Cabinet (ECC) decided that only those private power projects that succeeded, ahead of others, in achieving financial close before the cumulative limit of 3,000 MW should be allowed to implement their projects, and those that failed would have their bank guarantees encashed.

However, following a summary dated June 13, 1996, from the Ministry of Water and Power, the ECC modified its decision, stating that “for projects which held valid LOS on April 15, the entire performance guarantee be returned upon failing to achieve financial close on the due date.”

On September 1, 1996, the PPIB, via a letter, informed the respondent that financial close of private power projects with cumulative capacity in excess of 3,000 MW had taken place, and therefore its LOS “stands invalid at this time.” The respondent was further informed that its request for the grant of an extension was under consideration. The Supreme Court judgment stated that the return of the PG was to be in lieu of an agreement to release all parties from their obligations under the Implementation Agreement, Power Purchase Agreement, and Fuel Supply Agreement, along with a commitment not to pursue any legal claims, material or otherwise.

It noted that under normal circumstances, as per the terms of the LOS, the PPIB was entitled to encash the PG on the respondent’s failure to achieve financial close by the extended deadline of September 30, 1996. However, almost a month before this deadline, the PPIB, through its letter dated September 1, 1996, informed the respondent that its LOS was no longer valid. The PPIB’s basis for taking this position was the achievement of financial close for the cumulative capacity of 3,000 MW by other private power projects and not because the respondent had breached any provision of the LOS.

Copyright media, 2025