MUMBAI: India’s pension funds have asked the regulator to introduce a new category for debt investments that will allow them to hold bonds until they mature, sidestepping day-to-day price shocks, three sources, who are privy to the matter, said.

The request follows the regulator’s proposal in October that long-term bonds be valued on an accrual basis while others should be marked to market. Currently, all the bonds are marked to market.

Pension funds are major bond market investors in India. As of August end, they held 58% of the 8 trillion rupees (about $88 billion) assets under management in federal and state government bonds maturing in 10 years or more, data from the Pension Fund Regulatory and Development Authority (PFRDA) showed.

While the PFRDA has not specified what it means by long-term, fund managers worry that the proposal, if implemented, will lead to frequent switching of bond holdings, raising the risk of a fall in prices, which will impact returns for pensioners.

India central bank deputy warns of stablecoin risks, dismisses claims of utility

“Funds have proposed creation of a separate bucket to hold the HTM (held-to-maturity) securities, which would not be marked-to-market, so NAVs (net asset values) will be protected,” a private sector pension fund head said.

“This proposal is now being deliberated by the regulator,” the person said.

Accrual accounting recognises income from investments when it is earned.

The sources requested anonymity as they are not authorised to speak to the media. The pension regulator did not reply to a Reuters email seeking comment.

Pension funds’ demand for bonds has already taken a hit in recent months as the regulator has allowed them to invest more in equities.

“Changing valuation methodology will lead to distorted NAVs and would not be helpful,” another pension fund official said.

The regulator has been easing investment norms for pension funds, including offering bespoke solutions to savers with varied risk appetite. This week, it permitted funds to invest in gold and silver ETFs along with a wider set of listed equities.

The shift away from debt has pushed up borrowing costs, with yields on bonds of maturities of 15-year and more rising by 30-45 basis points so far this financial year. This has had a knock-on effect on pension funds’ assets.

“With a separate bucket, funds can keep longer-dated papers in HTM and manage the balance of the portfolio more smoothly and efficiently,” the third source said.

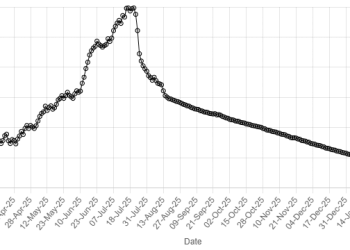

American Dollar Exchange Rate

American Dollar Exchange Rate