The Pakistan Stock Exchange (PSX) ended the final session of the week in the red, with the benchmark KSE-100 Index shedding over 550 points amid late-session selling on Friday.

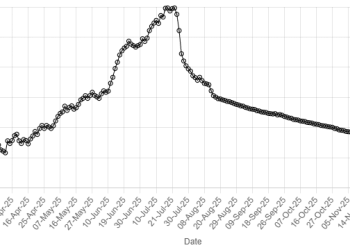

Trading kicked off on a positive note, pushing the KSE-100 to an intra-day high of 172,674.65.

However, the trend reversed during the final minutes of trading as investors booked profits in select stocks, dragging the index to an intra-day low of 171,149.07.

At close, the KSE-100 settled at 171,404.48, a decrease of 556.16 points or 0.32%

On a corporate front, Rafhan Maize Products Company Limited (RMPL) received a firm intention from Nishat Group–linked entities and members of the Mansha family to acquire control and up to 75.69% of its voting shares.

On Thursday, PSX continued its remarkable upward trajectory as the index surged to a new historic closing high, supported by declining Pakistan Investment Bond (PIB) yields, encouraging macroeconomic indicators, and heightened merger and acquisition activity across key sectors. The benchmark KSE-100 index advanced by 1,646.79 points or 0.97%.

Internationally, Asian share markets rebounded on Friday as a turnaround in tech lifted Wall Street, leaving investors counting down to a likely hike in interest rates from the Bank of Japan that could cause waves for currencies and bonds.

Sentiment also got a boost from a shock slowdown in US consumer price inflation to 2.7%, though analysts cautioned the data were clearly distorted lower by the government shutdown and could not be taken at face value.

Pricing for the Federal Reserve moved only marginally, with a rate cut in January implied at just 27%, while March nudged up to 58% from 54% before the data.

Markets imply around a 90% chance the BOJ will raise its rate a quarter point to 0.75% later Friday, with much resting on the outlook for further tightening ahead.

Investors are wagering on just one further move to 1.0% in 2026, and any hint of more could offer much-needed support to the embattled yen, but also pile pressure on government bonds.

For now, markets were content to follow Wall Street’s lead, and Japan’s Nikkei rose 0.6%. South Korea climbed 1.2% encouraged by stellar results from chipmaker Micron Technology.

MSCI’s broadest index of Asia-Pacific shares outside Japan added 0.2%.