Pakistan’s solar revolution has accelerated rapidly, but its benefits remain unevenly distributed across society. The equity gap captures the critical divide between users who can convert their willingness to adopt solar into actual installations, versus segments where willingness exists but constraints such as upfront capital requirements and lack of credit access prevent adoption, a recently launched study has argued.

This gap represents not just a market failure but a fundamental challenge to equitable energy transition, according to the study launched by think tank Renewables First.

“Early adoption has been dominated by affluent households and larger enterprises able to self-finance or access traditional credit channels. These segments have captured the lion’s share of benefits from the solar boom, while other segments remain unable to bridge the upfront investment gap despite having strong economic rationale for adoption. The emergence of hybrid solar-plus-battery systems represents the next stage of Pakistan’s distributed energy transition, initially driven by load-shedding and tariff shocks,” it said.

Solar power growth creates challenges to national grid: expert

Pakistan’s energy landscape has undergone a profound transformation in recent years, driven by a perfect storm of economic necessity, technological advancement, and market dynamics. The nation’s energy sector, historically burdened by heavy dependence on imported fuels, faced a critical juncture during the 2022 energy crisis that sent shockwaves through the economy.

“This crisis, coupled with subsequent economic fallout, catalyzed an unprecedented shift toward distributed solar energy that has fundamentally altered the country’s energy paradigm.,” the study said.

It further argued that early adoption was led by industrial and commercial users seeking power reliability and cost control.

“As battery pack prices nearly halved between 2023 and 2025, hybrid systems became viable for both enterprises and high-income households, enabling energy arbitrage and peak-shaving during expensive evening hours.”

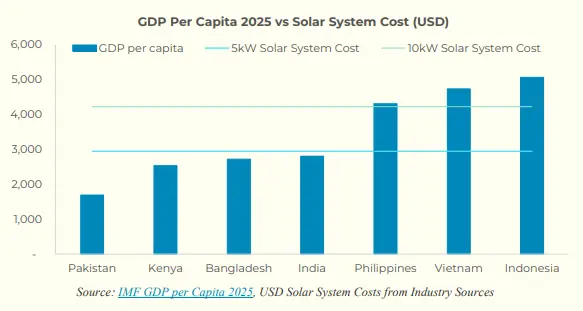

Despite the dramatic fall in global solar prices, “affordability remains a binding constraint on widespread adoption”, the study said.

“The cost of installation, while significantly reduced, still represents a substantial upfront investment that many potential adopters cannot afford without financing. This creates a vicious cycle where those who would benefit most from reduced electricity costs – lower-income households and small businesses facing the greatest burden from tariff increases – are least able to access the technology.”

According to the study, Pakistan’s distributed solar market holds an estimated Rs800 billion (USD 2.8 billion) in untapped lending potential across just three major cities, yet millions of households and small businesses remain locked out “due to structural financing constraints”.

“Despite explosive growth in solar adoption, the benefits have accrued disproportionately to affluent households and large enterprises able to self-finance installations.“

“The problem isn’t actual risk – it’s perceived risk,” said Naveen Ahmed, co-author of the study.

“We are missing out on good business simply because our internal systems haven’t caught up with market realities.

“The study highlights a striking paradox: while electricity tariffs have increased by over 200% since 2012, solar panel costs have fallen by 73% since 2017, resulting in payback periods of less than two years in many cases,” he was quoted as saying in a press release.

“Yet households spending up to 20% of their income on electricity and SMEs struggling with energy costs remain excluded due to rigid collateral requirements that prioritise asset ownership over cash-flow viability.”

Meanwhile, as per the study, banks operate at a sub-40% advances-to-deposits ratio while often demanding double collateralisation for solar loans.

China launches trade dispute against India over solar cells and IT goods

Distributed solar portfolios demonstrated sub-2% default rates, compared to 10%+ for traditional SME lending, it added.

“This represents a missing middle segment, enterprises and households too large for microfinance but too small or informal for commercial banks,” noted Shezad Abdullah, banker and co-author of the study.

Panelists at the launch emphasised that unlocking this opportunity required better segmentation and product design rather than blanket risk aversion.

Ammar Habib Khan, CEO of the National Credit Guarantee Company Limited (NCGCL), underscored, “before moving toward scaling financing, it is critical to identify which consumer and enterprise segments are eligible, understand their specific risk profiles, and tailor instruments accordingly.”

Similarly, Nejib Rehman, Managing Director of the Pakistan Banks’ Association, highlighted that banks were not fundamentally opposed to solar lending.

“The challenge lies in risk perception- questions around repayment consistency, property ownership (especially in apartments), limited historical data for solar financing, and ongoing regulatory uncertainty all shape lending decisions,” he explained.