MUMBAI: The Reserve Bank of India will infuse about $32 billion worth of rupee liquidity into the banking system over the next month via open market bond purchases and a buy/sell dollar-rupee swap, it said on Tuesday.

The RBI will purchase government bonds worth 2 trillion rupees ($22.34 billion) between December 29 and January 22 while also conducting a $10 billion 3-year dollar-rupee buy/sell swap on January 13.

The measures are expected to both infuse rupee liquidity into the banking system while also pulling out excess dollar liquidity that had contributed to a surge in dollar-rupee forward premiums, prompting bankers to urge market intervention by the central bank.

“The intent is quite clear that the RBI wants to inject durable liquidity into the banking system,” said Sakshi Gupta, principal economist at HDFC Bank.

Bankers urge RBI action as dollar glut, NDF pressure roil Indian rupee forwards

Seasonal factors and the central bank’s FX interventions have been a drag on rupee liquidity, and the size of the infusion should help sentiment in bonds in the near-term, Gupta said.

The RBI, under Governor Sanjay Malhotra, has stepped up liquidity injections to reinforce the impact of recent rate cuts.

The central bank has already infused 6.50 trillion rupees this calendar year via open market bond purchases, a record high.

It also conducted multiple dollar-rupee buy/sell swaps earlier this year, with the most recent one being a $5 billion 3-year swap conducted on December 16.

“We would see the 10-year benchmark bond yield moving below 6.60% mark in early trades tomorrow. Post that, the move will depend on the choice of papers for next week’s OMO,” a treasury head at a private sector bank said, referring to the impact of the liquidity measures.

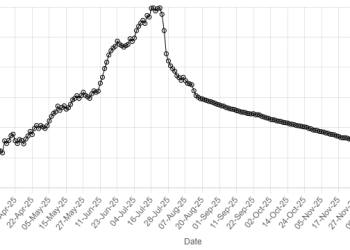

The 10-year yield closed at 6.6328% on Tuesday.

Traders in the FX market, meanwhile, said that while the swap would help ease the sharp upwards momentum in forward premiums seen in recent days, it’s unlikely to address the immediate limitations around excess dollar liquidity heading into the year-end.

Banks can typically manage excess dollar liquidity by placing deposits with other lenders. However, regulatory constraints at quarter-ends, particularly at the calendar year-end, limit this option.