TOKYO: Japan’s super-long bonds fell on Wednesday, pushing long-end yields to a record high, as concerns grew over debt-funded government stimulus.

The 30-year Japanese government bond (JGB) yield rose 2.5 basis points (bps) to 3.45%, eclipsing the previous record reached earlier this week.

The 40-year JGB yield rose 1.5 bp to 3.715%. Long-term yields have climbed sharply since early November amid speculation over the size of Prime Minister Sanae Takaichi’s debt-funded stimulus, while short-term yields have risen after the Bank of Japan signalled its readiness to continue raising rates.

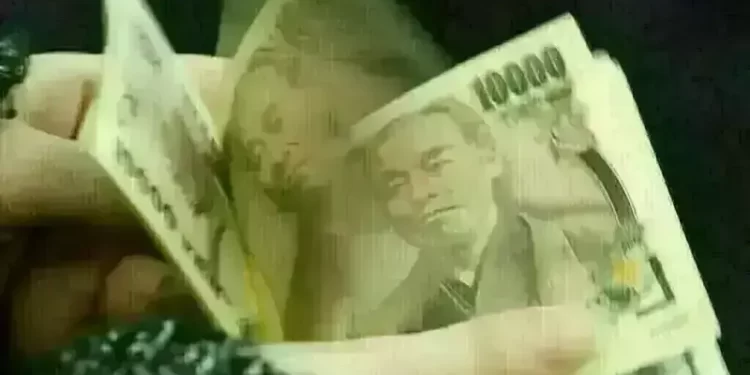

Japan is preparing to issue new government bonds of around 29.6 trillion yen ($189.55 billion) for the 2026 financial year budget, public broadcaster NHK said on Wednesday.

Takaichi reiterated in a Nikkei interview published on Tuesday that her “proactive” fiscal plan does not entail irresponsible bond issuance or tax cuts.

The benchmark 10-year yield, which last week breached the 2% level for the first time in 26 years after the BOJ’s rate hike, fell 1.5 basis points to 2.025%.

“Since the Bank of Japan’s December policy meeting, the move to entrench 10-year yields in the 2% range appears to be accelerating,” Noriatsu Tanji, chief bond strategist at Mizuho Securities, wrote in a note.