KUALA LUMPUR: Malaysian palm oil futures rose on Friday and were poised for their first weekly gain in three, buoyed by stronger rival Dalian oils, although a firmer ringgit capped the gains.

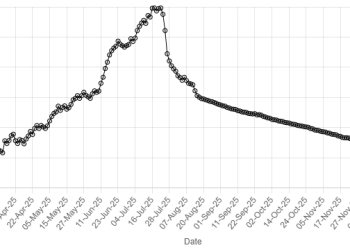

The benchmark palm oil contract for March delivery on the Bursa Malaysia Derivatives Exchange gained 31 ringgit, or 0.77%, to 4,068 ringgit ($1,007.93) a metric ton by the midday break.

The contract has risen 3.38% so far this week.

The market posted a strong rally, tracking strength in Dalian oils even as the ringgit strengthened 0.17% to 4.0360, a Kuala Lumpur-based trader said.

Dalian’s most-active soyoil contract rose 0.77%, while its palm oil contract gained 0.37%.

Soyoil on the Chicago Board of Trade will reopen at 1430GMT.

Palm oil tracks price movements of rival edible oils, as it competes for a share of the global vegetable oils market.

The ringgit, palm’s currency of trade, strengthened 0.17% against the dollar, making the commodity more expensive for buyers holding foreign currencies.

Oil prices climbed after the United States ordered increased economic pressure on Venezuelan oil shipments and carried out airstrikes against Islamic State militants in northwest Nigeria at the request of Nigeria’s government.

Stronger crude oil futures make palm a more attractive option for biodiesel feedstock.

Meanwhile, Indonesia has identified potential fines amounting to $8.5 billion that the government could collect in 2026 from palm oil companies and miners operating illegally in forest areas, the country’s attorney general said.

Palm oil may break resistance at 4,042 ringgit per ton and rise to 4,078 ringgit, Reuters technical analyst Wang Tao said.