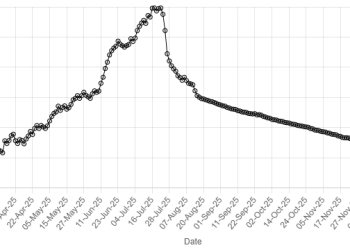

The yuan slipped against the dollar on Friday after China’s central bank sent a strong signal through its midpoint fixing, cautioning against a rapid appreciation of the currency which hovered just shy of the psychologically key 7-per-dollar level.

Major state-owned banks were seen actively buying dollars in the onshore spot market and quickly recycling those dollars into the swap market, traders said.

The combination of moves was also interpreted as an effort to slow the yuan’s gains.

Prior to market opening, the People’s Bank of China (PBOC) set the midpoint rate at 7.0358 per dollar, its strongest since September 2024 but 306 pips weaker than a Reuters’ estimate of 7.0052.

The spot yuan is allowed to trade a maximum of 2% either side of the fixed midpoint each day.

The gap between the official midpoint and Reuters’ market-based estimate represented the largest weak-side deviation since data became available in 2022.

The pushback against fast appreciation came after the offshore yuan briefly rose past the key 7 level a day earlier, fueling market expectations that the onshore unit would follow suit and continue strengthening.

The last time it was at the 7-per-dollar level was in May 2023.

“The recent yuan appreciation stemmed from short-term positive factors … rather than signaling the start of a new appreciation cycle,” said Guan Tao, global chief economist at Bank of China International Securities and a former senior official at the State Administration of Foreign Exchange.

“Overall, the renminbi exchange rate is unlikely to follow a one-sided trend next year and is more likely to fluctuate around the 7 mark.”

The onshore yuan traded at 7.0085 per dollar as of 0403 GMT, down 0.04% from the previous late-night close. Its offshore counterpart last fetched 7.0028.

Trillion-dollar trade surplus

China’s resilient exports lent support as the trade surplus topped $1 trillion for the first time in the first 11 months of this year. Strength in the currency was also underpinned by heavier seasonal demand, some currency traders said, as exporters usually convert more of foreign exchange receipts into the local currency to meet various payments, including administrative requirements and for employees, toward the year-end.

“Yuan appreciation against the dollar will have a limited impact on China’s exports in the short term,” Luo Zhiheng, chief economist at Yuekai Securities, said in a note.

“It is necessary to guard against an excessively rapid and one-sided yuan appreciation to avoid creating shocks on business operations and financial markets.”

Luo said moderate yuan rises could help improve the balance of payments to reduce trade frictions with other economies and enhance the yuan’s purchasing power abroad.

Global investment houses widely expect the yuan’s upward momentum to extend into the new year and test the key 7 mark.

The PBOC reiterated its pledge for a stable yuan while emphasising enhancing foreign exchange market resilience and stabilising market expectations, according to a readout of its latest monetary policy committee meeting published on Wednesday.

“This pattern suggests that the PBOC may have developed a preference for a stronger yuan, while remaining keen to avoid too fast an appreciation,” said Xinquan Chen, China economist at Goldman Sachs. Goldman maintains its forecast for the yuan to rise to 6.95, 6.90 and 6.85 in three, six and 12 months.