The Pakistan Stock Exchange (PSX) continued with its record-breaking spree as the benchmark KSE-100 Index settled at a new all-time high on Tuesday.

The benchmark index remained in positive territory throughout the day.

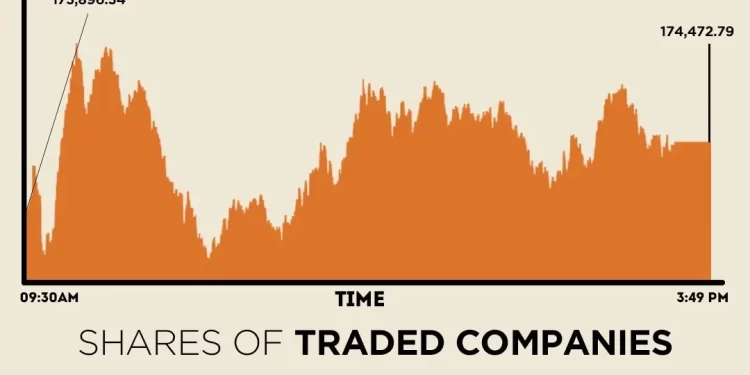

The market opened on a firm note and quickly climbed to an intra-day high of 174,805.15 during early trading. However, profit-taking led to a mid-morning pullback, with the index slipping to an intra-day low of 174,121.41.

Thereafter, the market stabilised and traded in a narrow range as the index recovered gradually through the afternoon session.

At close, the KSE-100 Index settled at 174,472.79, an increase of 576.45 points or 0.33%.

Heavyweight stocks including OGDC, UBL, PPL, PSO, and HUBC led the rally, collectively contributing around 565 points to the index’s overall gain, brokerage house Topline Securities said.

In a key development, Pakistan achieved a landmark breakthrough in Islamic finance as the Ministry of Finance (MoF) set a historic record by issuing over Rs2 trillion worth of Sukuk in 2025, the highest-ever Sukuk issuance in a single calendar year since 2008.

On the corporate front, Meezan Bank Limited (MEBL) announced the appointment of Dr Syed Amir Ali as its president and Chief Executive Officer (CEO).

The PSX on Monday delivered another strong session, closing at a fresh all-time high as positive investor sentiment continued to drive buying interest. The benchmark KSE-100 Index gained 1,496 points to close at a new all-time high of 173,896 points.

Internationally, Asian shares slipped on Tuesday, tracking Wall Street’s tech slump. At the same time, silver and gold steadied after a sharp pullback from record highs took some froth off the precious metals’ incredible rally.

Also adding to global geopolitical tensions, China launched 10 hours of live-firing exercises around Taiwan on Tuesday.

Liquidity across most markets is thin in a holiday-shortened week, leading to sharp and volatile price swings.

On Tuesday, MSCI’s broadest index of Asia-Pacific shares outside Japan slipped 0.1% but was set for an annual gain of 26.7%, its best performance since 2017.

Japan’s Nikkei eased 0.2% but was also up 26% for the year.

Taiwanese shares lost 0.7% and China’s blue chips fell 0.3% after Beijing’s live-firing exercises around Taiwan.

Meanwhile, the Pakistani rupee reported marginal gain against the US dollar in the inter-bank market on Tuesday. At close, the local currency settled at 280.15, a gain of Re0.01 against the greenback.

Volume on the all-share index decreased to 851.04 million from 858.05 million recorded in the previous close. The value of shares rose to Rs44.90 billion from Rs42.87 billion in the previous session.

Trust Brokerage was the volume leader with 57.46 million shares, followed by Fauji Foods Ltd with 54.42 million shares, and Unity Foods Ltd with 49.22 million shares.

Shares of 479 companies were traded on Tuesday, of which 282 registered an increase, 158 recorded a fall, and 39 remained unchanged.