MUMBAI: Indian government bonds slipped on Friday after a weak auction revived supply concerns, with traders wary ahead of the states’ January–March borrowing calendar due later in the day.

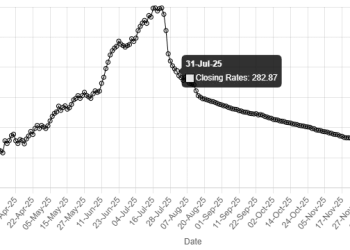

The benchmark 10-year yield settled at 6.6062%, up from 6.5818% on Thursday. It rose 4.5 bps this week.

Bond yields rise when prices fall.

New Delhi sold 320 billion rupees ($3.56 billion) of the benchmark 10-year bond at a cut-off yield of 6.61%, in line with expectations but 13 basis points higher than its previous auction on December 5.

The 10-year yield has risen 10 basis points over the same period.

It also briefly breached a key technical level during the session, adding to pressure.

“6.62% is a crucial level, and if that is breached, we may see 6.70% again,” said Gopal Tripathi, head of treasury and capital markets at Jana Small Finance Bank.

In the last 17 trading sessions, the 10-year yield has broken the 6.62% barrier only two times in eight attempts.

Focus is now on the states’ January–March borrowing calendar, expected after market hours on Friday, with investors bracing for a record quarterly issuance of about 5 trillion rupees.

Traders said sentiment has stayed subdued due to a supply-demand mismatch in the market, but see demand improving once India’s fully accessible route (FAR) bonds are added to the Bloomberg Global Aggregate Index. The market is watching for an inclusion decision later this month.

Rising U.S. Treasury yields are also weighing on India bonds, traders said.

The U.S. 10-year bond yield was trading at 4.1592% in Asian hours, up about 5 basis points in the last three sessions.

RATES

India’s overnight index swap rate curve steepened further on Friday, as paying pressure persisted in the longer-duration swaps.

The one-year OIS rate was little changed at 5.4750%, and the two-year OIS rate rose 2 bps to 5.5750%. The five-year OIS rate ended 3.5 bps higher at 5.9550%.