MUMBAI: Indian government bonds rebounded on Tuesday, snapping a two-session losing streak, as the market absorbed hefty state debt supply without any major spike in yields, boosting sentiment.

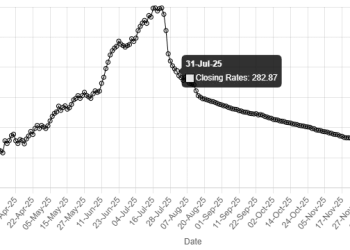

The benchmark 10-year yield settled at 6.6137%, against the previous close of 6.6331%.

Bond yields move inversely to prices.

Indian states successfully raised 301 billion rupees ($3.34 billion) through bond sales earlier in the day. While the notes were sold at yields that were slightly higher than the previous auction cutoffs, investors sought relief in the fact that the auction was fully subscribed in a market with faltering demand.

Traders were concerned about the auction’s success, following last week’s sharp decline in prices after states announced a record borrowing plan for January-March.

India’s 10-year bond yield rose 5 basis points in two sessions after the announcement. State-run banks emerged as buyers during this time, purchasing a net 125 billion rupees over three sessions.

These lenders have been snapping up bonds as the Reserve Bank of India continues its open market purchases. The RBI bought bonds worth 500 billion rupees on Monday and is set to buy another 1 trillion rupees of bonds in January. The central bank will also conduct a foreign exchange swap worth $10 billion next Tuesday.

As state debt supply concerns ease, the market’s attention is likely to pivot to the central government’s budget announcement in February, traders said.

“Traders are now cautiously waiting for the budget as the gross borrowing number beat expectations due to maturities this year,” said Alok Sharma, head of treasury at ICBC, Mumbai.

RATES

India’s longer-duration overnight index swap rates fell, reversing course after three sessions.

The one-year OIS inched lower to 5.4775%, while the two-year OIS rate fell 1 bp to 5.5750%. The five-year OIS rate was down 2.25 bps at 5.9525%.