The Central Directorate of National Savings (CDNS) has reduced profit rates on the majority of its National Savings Schemes (NSS), effective January 05, 2026.

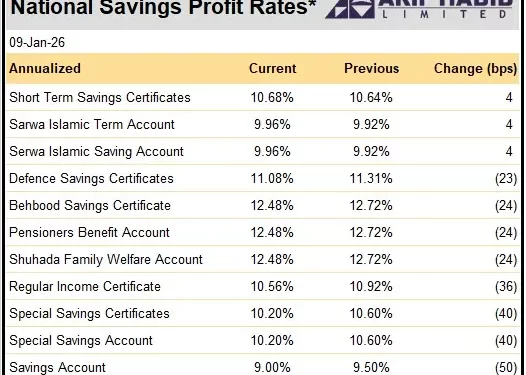

According to data compiled by Arif Habib Limited, released on Friday, the return on Special Savings Certificates (SSC) was cut by 40 basis points (bps) to 10.20%, while Regular Income Certificates saw a reduction of 36bps to 10.56%. Similarly, the Savings Account Rate was lowered by 50bps to 9.00% from 9.50%, marking one of the steepest declines among the schemes.

Rates on the Pensioners’ Benefit Account, Behbood Savings Certificate, and Shuhada Family Welfare Account were each reduced by 24bps to 12.48% from 12.72%, while the Defence Savings Certificate rate was cut by 23bps to 11.08%.

In contrast, Islamic savings products showed a reversed trend. The Sarwa Islamic Term Account edged up by 4bps to 9.96%, the Sarwa Islamic Saving Account recorded a notable increase of 4bps, taking the rate to 9.96%, making it one of the few instruments to offer higher returns after the revision.

Market participants view the across-the-board reduction as aligned with expectations of a gradual decline in key interest rates amid moderating inflation and improving macroeconomic indicators.

Last month, contrary to market expectations, the Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) decided to reduce the policy rate by 50bps to 10.5%.

The National Savings Organisation is Pakistan’s largest financial institution, managing a portfolio exceeding Rs3.4 trillion and serving over 4 million customers through a network of 376 branches across the country, administered by 12 Regional Directorates.

The CDNS helps the government finance budgetary deficits and support critical infrastructure projects.