SHANGHAI: Mainland China and Hong Kong stocks advanced on Friday, with the Shanghai benchmark touching a decade-high level, as investor sentiment improved on signs of easing deflationary pressures.

- China’s annual consumer price inflation accelerated to a 34-month high in December, while producer deflation persisted, backing market expectations for additional stimulus to shore up soft demand.

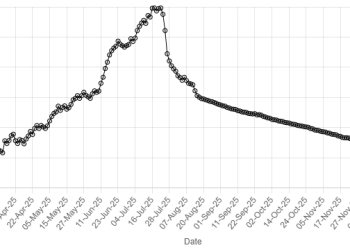

- The benchmark Shanghai Composite index surged to an intraday high of 4,121.7 points, its highest level since July 2015, before easing to a 0.3% gain at 4,095.33 points by the midday break.

- The blue-chip CSI300 index inched 0.1% higher.

- In Hong Kong, the benchmark Hang Seng Index was up 0.03%.

- “We remain positive on Chinese equities, partly because we expect China’s efforts to balance domestic demand and supply to be supportive for the earnings outlook and to drive upward consensus earnings estimate revisions,” said William Bratton, head of cash equity research for APAC at BNP Paribas Exane.

- “However, given the expected sequencing of realised impacts, we have a near-term preference for sub-industries in materials, industrials, and technology over their direct consumer-facing peers.”

- CSI 300 Material sub-index rose 1.35%, while the Hang Seng Material Index gained 2.46% at the lunch break on Friday.

- Signs of easing trade tensions between the world’s two largest economies, authorities’ pledge to boost domestic demand and support the broad economy should continue to support A shares, said Zeng Wanping, investment director at Panshi Fund.

- And he also noted that the overall valuation of A shares are not very high. Separately, Chinese artificial intelligence model developer MiniMax Group jumped 50% in its Hong Kong market debut on Friday after raising HK$4.8 billion.

- Market will shift their focus to trade and credit lending data due next week for more clues on the health of the world’s second largest economy. ‑Reuters