MUMBAI: Indian government bonds fell in early deals on Friday, as traders anxiously awaited fresh debt supply amid lingering concerns over demand for the quarter’s record debt sales.

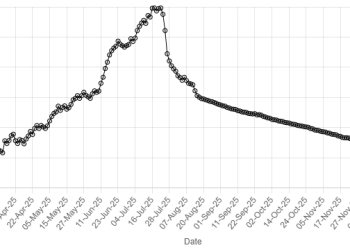

The benchmark 10-year 6.48% 2035 bond yield was at 6.6376% as of 10:00 a.m. IST, after ending at 6.6290% on Thursday. Bond yields move inversely to prices.

Traders are selling debt at any little rise in price as the market knows more debt is lined up, a trader with a state-run bank said.

“The near-term tone is cautious because the street has to digest a lot of issuance, and that keeps yields sticky.”

New Delhi will sell 15-year and 40-year bonds worth about 290 billion rupees ($3.22 billion) later in the day.

The centre and states are set to raise a record 8 trillion rupees through bond sales in the January-March quarter, and this continues to bother investors.

Bonds have been under selling pressure even as the Reserve Bank of India has been supportive through debt purchases.

It has already purchased bonds worth 2 trillion rupees since December, and is scheduled to buy papers worth another 1 trillion rupees in January.

However, the RBI has been choosing papers that are largely not traded, dampening expectations that the central bank would include the former benchmark bond and other liquid papers in these operations.

Another major factor would be the prospect of inclusion of Indian bonds in Bloomberg’s Global Aggregate Index later in the year, and the announcement is expected before the end of next week.