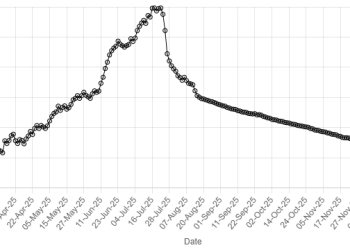

Massive selling pressure was observed at the Pakistan Stock Exchange (PSX), as the benchmark KSE-100 Index shed over 2,000 points on Monday.

The market opened on a weak note, with the index slipping sharply in early trade, reflecting immediate selling pressure.

The index staged a recovery during the late morning session, hitting an intra-day high of 184,439.06. However, selling resumed, gradually eroding earlier gains as the index trended downward.

At close, the index settled at 182,384.14, a decrease of 2,025.53 points or 1.10%.

During the previous week, Pakistan’s equity market maintained strong upward momentum during the outgoing week, as sustained domestic buying, easing monetary conditions and supportive global cues combined to lift investor sentiment, pushing the benchmark index decisively higher.

The KSE-100 Index advanced 5,375 points, or 3% week-on-week, to close at 184,410 points, extending gains at the start of calendar year 2026.

Internationally, the US dollar fell, and US equity futures slid after Federal Reserve Chair Jerome Powell said the Trump administration threatened him with a criminal indictment, stoking investor worries about the central bank’s independence.

S&P 500 futures were down 0.5%, while European futures slipped 0.1% in the Asia morning, and the dollar was roughly 0.2% lower against most major peers, sending it below 158 yen and to $1.1660 per euro.

Traders said the news was unsettling, though the immediate implication for interest rates was not clear. Benchmark 10-year Treasury futures rose 3 ticks for an implied yield of 4.15%, which is about a basis point below Friday’s cash market close.

Fed fund futures have added about three basis points more in cuts this year, which is small but points to the risk that the Fed gets pushed into being more aggressive. Gold struck a record high of more than $4,600 an ounce, as unrest in Iran lifted precious metal prices and supported oil.

On Sunday, Powell said the Trump administration had threatened him with a criminal indictment and served grand jury subpoenas over Congressional testimony he gave last summer regarding a Fed building renovation project, an action he called a “pretext” aimed at pressuring the central bank to cut interest rates.

Meanwhile, the Pakistani rupee registered marginal improvement against the US dollar in the inter-bank market on Monday. At close, the local currency settled at 280.01, a gain of Re0.01 against the greenback.

Volume on the all-share index increased to 1,058.8 million from 1,033.8 million recorded in the previous close. However, the value of shares declined to Rs48.24 billion from Rs52.92 billion in the previous session.

Fauji Foods Ltd was the volume leader with 65.62 million shares, followed by WorldCall Telecom with 51.26 million shares, and Hascol Petrol with 47.26 million shares.

Shares of 481 companies were traded on Monday, of which 161 registered an increase, 284 recorded a fall, and 36 remained unchanged.