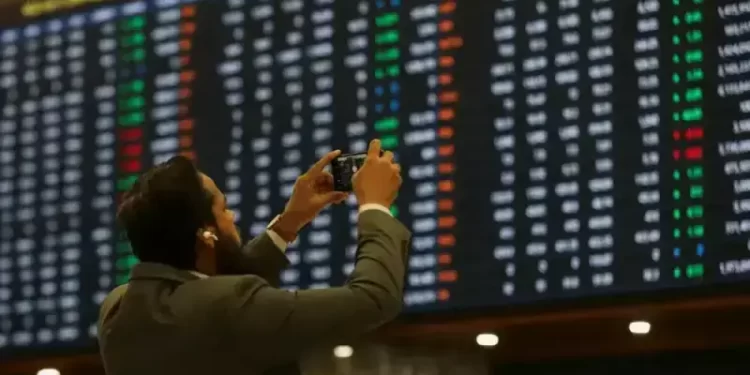

A day after observing massive selling, positive sentiments returned to the Pakistan Stock Exchange (PSX) on Tuesday, with the benchmark KSE-100 Index gaining over 800 points during the opening minutes of trading.

At 9:30am, the benchmark index was hovering at 183,201.76, an increase of 817.62 points or 0.45%.

Buying interest was seen in key sectors, including automobile assemblers, commercial banks, fertilizer, oil and gas exploration companies, OMCs and power generation. Index-heavy stocks, including HUBCO, MARI, OGDC, POL, PPL, PSO, SSGC, HBL, NBP and UBL, traded in the green.

In a key development, the Federal Board of Revenue (FBR) has asked the business community to suggest new taxation measures for increasing of incidence of tax on affluent classes. In this regard, the FBR has sought budget proposals from the business and trade for new fiscal year.

Pakistan’s equity market ended Monday’s trading session on a sharply negative note as investors resorted to aggressive profit-taking following last week’s robust gains. The KSE-100 Index closed at 182,384.15 points, posting a decline of 2,025.52 points or 1.1%.

Internationally, a surge in Japanese shares led Asia higher on Tuesday amid investor bullishness over all things AI, while the cloud of uncertainty over Federal Reserve independence favoured gold even as it weighed on the dollar.

In share markets, Japan’s Nikkei returned from holiday with a jump of 3.4% to record highs, aided by a weak yen and talk of fiscal stimulus. South Korea and Taiwan also hit all-time peaks, while Chinese blue chips scaled a four-year top.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.8% to a fresh record peak.

In European markets, EUROSTOXX 50 futures added 0.2%, while DAX futures gained 0.1% and FTSE futures went flat.

S&P 500 futures eased 0.2% and Nasdaq futures 0.3% ahead of a key reading on U.S. consumer prices for December. Forecasts are for annual core inflation to nudge up to 2.7%, though analysts at Goldman Sachs are tipping 2.8%.

This is an intra-day update