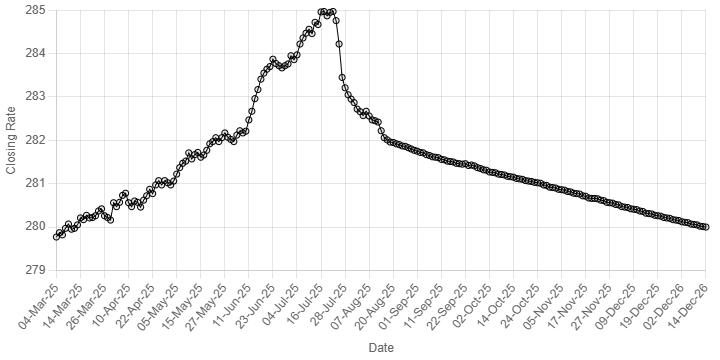

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”, “13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”, “05-May-25”, “06-May-25”, “07-May-25”, “08-May-25”, “09-May-25”, “12-May-25”, “13-May-25”, “14-May-25”, “15-May-25”, “16-May-25”, “19-May-25”, “20-May-25”, “21-May-25”, “22-May-25”, “23-May-25”, “26-May-25”, “27-May-25”, “29-May-25”, “30-May-25”, “02-Jun-25”, “03-Jun-25”, “04-Jun-25”, “05-Jun-25”, “10-Jun-25”, “11-Jun-25”, “12-Jun-25”, “13-Jun-25”, “16-Jun-25”, “17-Jun-25”, “18-Jun-25”, “19-Jun-25”, “20-Jun-25”, “23-Jun-25”, “24-Jun-25”, “25-Jun-25”, “26-Jun-25”, “27-Jun-25”, “30-Jun-25”, “02-Jul-25”, “03-Jul-25”, “04-Jul-25”, “07-Jul-25”, “08-Jul-25”, “09-Jul-25”, “10-Jul-25”, “11-Jul-25”, “14-Jul-25”, “15-Jul-25”, “16-Jul-25”, “17-Jul-25”, “18-Jul-25”, “21-Jul-25”, “22-Jul-25”, “23-Jul-25”, “24-Jul-25”, “25-Jul-25”, “28-Jul-25”, “29-Jul-25”, “30-Jul-25”, “31-Jul-25”, “01-Aug-25”, “04-Aug-25”, “05-Aug-25”, “06-Aug-25”, “07-Aug-25”, “08-Aug-25”, “11-Aug-25”, “12-Aug-25”, “13-Aug-25”, “15-Aug-25”, “18-Aug-25”, “19-Aug-25”, “20-Aug-25”, “21-Aug-25”, “22-Aug-25”, “25-Aug-25”, “26-Aug-25”, “27-Aug-25”, “28-Aug-25”, “29-Aug-25”, “01-Sep-25”, “02-Sep-25”, “03-Sep-25”, “04-Sep-25”, “05-Sep-25”, “08-Sep-25”, “09-Sep-25”, “10-Sep-25”, “11-Sep-25”, “12-Sep-25”, “15-Sep-25”, “16-Sep-25”, “17-Sep-25”, “18-Sep-25”, “19-Sep-25”, “21-Sep-25”, “22-Sep-25”, “23-Sep-25”, “24-Sep-25”, “25-Sep-25”, “26-Sep-25”, “29-Sep-25”, “30-Sep-25”, “01-Oct-25”, “02-Oct-25”, “03-Oct-25”, “06-Oct-25”, “07-Oct-25”, “08-Oct-25”, “09-Oct-25”, “10-Oct-25”, “13-Oct-25”, “14-Oct-25”, “15-Oct-25”, “16-Oct-25”, “17-Oct-25”, “20-Oct-25”, “21-Oct-25”, “22-Oct-25”, “23-Oct-25”, “24-Oct-25”, “27-Oct-25”, “28-Oct-25”, “29-Oct-25”, “30-Oct-25”, “31-Oct-25”, “03-Nov-25”, “04-Nov-25”, “05-Nov-25”, “06-Nov-25”, “07-Nov-25”, “10-Nov-25”, “11-Nov-25”, “12-Nov-25”, “13-Nov-25”, “14-Nov-25”, “17-Nov-25”, “18-Nov-25”, “19-Nov-25”, “20-Nov-25”, “21-Nov-25”, “24-Nov-25”, “25-Nov-25”, “26-Nov-25”, “27-Nov-25”, “28-Nov-25”, “01-Dec-25”, “02-Dec-25”, “03-Dec-25”, “04-Dec-25”, “05-Dec-25”, “08-Dec-25”, “09-Dec-25”, “10-Dec-25”, “11-Dec-25”, “12-Dec-25”, “15-Dec-25”, “16-Dec-25”, “17-Dec-25”, “18-Dec-25”, “19-Dec-25”, “22-Dec-25”, “23-Dec-25”, “24-Dec-25”, “26-Dec-25”, “29-Dec-25”, “30-Dec-25”, “31-Dec-25”, “02-Dec-26”, “05-Dec-26”, “06-Dec-26”, “07-Dec-26”, “08-Dec-26”, “09-Dec-26”, “12-Dec-26”, “13-Dec-26”, “14-Dec-26”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06, 281.22, 281.37, 281.47, 281.52, 281.71, 281.57, 281.67, 281.72, 281.61, 281.66, 281.77, 281.92, 281.97, 282.06, 281.97, 282.06, 282.17, 282.07, 282.02, 281.97, 282.12, 282.22, 282.17, 282.21, 282.47, 282.67, 282.96, 283.17, 283.41, 283.55, 283.64, 283.70, 283.87, 283.77, 283.72, 283.67, 283.72, 283.76, 283.95, 283.86, 283.97, 284.22, 284.36, 284.47, 284.56, 284.46, 284.72, 284.67, 284.96, 284.97, 284.87, 284.95, 284.97, 284.76, 284.22, 283.45, 283.21, 283.05, 282.95, 282.87, 282.72, 282.66, 282.57, 282.67, 282.56, 282.47, 282.45, 282.42, 282.22, 282.06, 282.01, 281.96, 281.95, 281.92, 281.90, 281.87, 281.86, 281.83, 281.8, 281.77, 281.75, 281.72, 281.71, 281.67, 281.65, 281.62, 281.61, 281.60, 281.56, 281.55, 281.52, 281.51, 281.50, 281.47, 281.46, 281.45, 281.46, 281.42, 281.43, 281.41, 281.37, 281.35, 281.32, 281.31, 281.27, 281.26, 281.25, 281.22, 281.21, 281.20, 281.17, 281.16, 281.15, 281.12, 281.11, 281.10, 281.07, 281.06, 281.05, 281.03, 281.02, 281.01, 280.97, 280.96, 280.92, 280.91, 280.90, 280.87, 280.86, 280.85, 280.82, 280.81, 280.78, 280.77, 280.76, 280.72, 280.71, 280.67, 280.66, 280.66, 280.65, 280.62, 280.61, 280.57, 280.56, 280.55, 280.52, 280.51, 280.47, 280.46, 280.45, 280.42, 280.41, 280.40, 280.37, 280.36, 280.32, 280.31, 280.30, 280.27, 280.26, 280.25, 280.22, 280.21, 280.20, 280.17, 280.16, 280.15, 280.12, 280.11, 280.10, 280.07, 280.06, 280.05, 280.02, 280.01, 280.0, 279.97

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee strengthened against the US dollar, appreciating 0.01% in the inter-bank market on Wednesday.

At close, the local currency settled at 279.97, a gain of Re0.03 against the greenback.

On Tuesday, the local unit closed at 280.00.

Internationally, the US dollar recovered ground to near a one-month high in early Asian trade on Wednesday after US CPI data that was broadly in line with estimates, firming up expectations that the Federal Reserve will remain on hold later this month despite unprecedented pressure from the White House to lower interest rates.

The US dollar index, which measures the greenback’s strength against a basket of six currencies, was last up 0.3% at 99.18, retracing losses from Monday after US President Donald Trump threatened Fed Chair Jerome Powell with a criminal indictment.

Global central bank chiefs and top Wall Street bank CEOs lined up in support of Powell on Tuesday.

On Tuesday, data showed US consumer prices increased 0.3% in December compared to the previous month, lifted by higher costs for rents and food as some of the distortions related to the government shutdown that had artificially lowered inflation in November unwound.

The print cemented expectations that the Federal Reserve would leave interest rates unchanged this month, with Fed funds futures currently pricing an implied 95.6% probability that the U.S. central bank will remain on hold when its next two-day meeting concludes on 28 January, unchanged from a day earlier, according to the CME Group’s FedWatch tool.

Volatility in most currency pairs was subdued in early Asian trading ahead of a possible Supreme Court ruling on the legality of Trump’s emergency tariffs.

Oil prices, a key indicator of currency parity, rose on Wednesday for a fifth straight session on fears of Iranian supply disruptions due to a potential U.S. attack on Iran and possible retaliation against U.S. regional interests.

Brent futures were up 76 cents, or 1.2%, at $66.23 a barrel at 1411 GMT. U.S. West Texas Intermediate crude was up 68 cents, or 1.1%, at $61.83 a barrel.

Inter-bank market rates for dollar on Wednesday

BID Rs 279.97

OFFER Rs 280.17

Open-market movement

In the open market, the PKR gained 4.00 paisa for buying and 5.00 paisa for selling against USD, closing at 280.38 and 281.00, respectively.

Against Euro, the PKR gained 56.00 paisa for buying and 54.00 paisa for selling, closing at 326.60 and 329.75, respectively.

Against UAE Dirham, the PKR remained unchanged for buying and lost 1.00 paisa for selling, closing at 76.50 and 77.24, respectively.

Against Saudi Riyal, the PKR gained 1.00 paisa for buying and remained unchanged for selling, closing at 74.82 and 75.41, respectively.

Open-market rates for dollar on Wednesday

BID Rs 280.38

OFFER Rs 281.00