BENGALURU: India’s central bank has granted an “in-principle” approval to Japan’s Sumitomo Mitsui Banking Corp (SMBC) for setting up a wholly-owned subsidiary in the country, the regulator said in a statement on Wednesday.

SMBC, which last year picked up a 24% stake in Indian lender Yes Bank, was so far operating in India through a branch. A Indian subsidiary will give the bank greater flexibility in its operations.

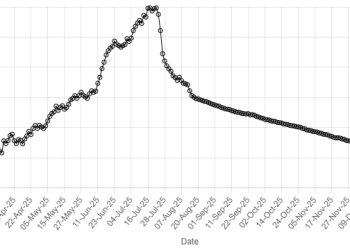

Indian central bank’s $10 billion FX swap subscribed three times over

A wholly-owned subsidiary is a separate legal entity in India that allows a bank treatment similar to local peers, including freedom to open branches without restriction.

Such a subsidiary’s capital is ring-fenced from the parent bank’s.