LONDON: Copper dropped on Tuesday with industrial consumers beginning to resist paying elevated prices when inventory levels are at multi-year highs.

Benchmark three-month copper on the London Metal Exchange was down 0.8% at $12,868 a metric ton at 1045 GMT after rebounding by 1.3% in the previous session.

LME copper has surged by 30% over the past six months, touching a record peak of $13,407 last week, driven by speculative buying on the back of worries that mine disruptions will create shortages.

“Copper cannot run away from the fact that it is an industrial metal and consumers are starting to baulk at these high prices at a time where exchange-monitored inventory levels are at the highest level in eight years,” said Ole Hansen, head of commodity strategy at Saxo Bank in Copenhagen.

Copper bounces on weak dollar, Chinese data

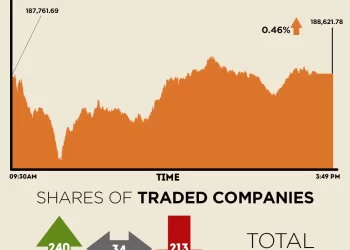

Inventories in warehouses registered with the Shanghai Futures Exchange have more than doubled since December 1 to 213,515 metric tons while stocks in U.S. Comex storage facilities have surged by 127% to 542,914 short tons over the past six months.

“Metals have been in such hot demand as hard assets given all the uncertainties that we have in the world, but ultimately for now it leaves gold as the superior metal for safety,” Hansen added.

Gold surged past the $4,700 an ounce mark for the first time on Tuesday to another record high.

LME lead was the biggest loser on the LME, falling 1.1% to $2,038 a ton after inventories jumped by 11% in one day, according to LME data.

LME nickel dipped 0.4% to $18,070 a ton despite miner PT Vale Indonesia saying that the mining production quota it received will likely be insufficient to meet demand from the smelters in its pipeline for this year.

Among other metals, aluminium dropped 0.7% to $3,135.50 a ton, zinc shed 0.8% to $3,195.50 while tin jumped 2.7% to $50,600.