KUALA LUMPUR: Malaysian palm oil futures ended higher on Tuesday, as anticipation of a sharp decline in production and stronger export demand supported the market.

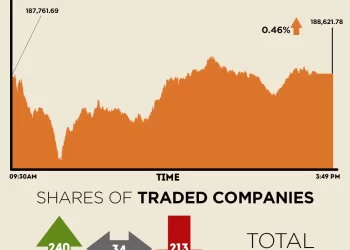

The benchmark palm oil contract for April delivery on the Bursa Malaysia Derivatives Exchange gained 28 ringgit, or 0.69%, to 4,095 ringgit ($1,010.61) a metric ton at the close.

The market was supported as traders are now expecting an output plunge of approximately 15% to 17% for January and as exports have improved significantly, signaling strong demand, said Paramalingam Supramaniam, director at Selangor-based brokerage Pelindung Bestari.

“Overall, if both these variables continue right up to March, there could be a significant drawdown on end stocks,” he said.

Cargo surveyors estimated that exports of Malaysian palm oil products for January 1-20 rose between 8.64% and 11.4% from a month earlier.

Dalian’s most-active soyoil contract rose 0.43%, while its palm oil contract added 1.2%. Soyoil prices on the Chicago Board of Trade were down 0.04%.

Palm oil tracks price movements of rival edible oils, as it competes for a share of the global vegetable oils market.

Oil prices were steady as investors monitored U.S. President Donald Trump’s threats of higher tariffs on European states over his drive to acquire Greenland, while firmer global economic growth expectations and better-than-expected economic data from China gave a floor to prices.

Stronger crude oil futures make palm a more attractive option for biodiesel feedstock.

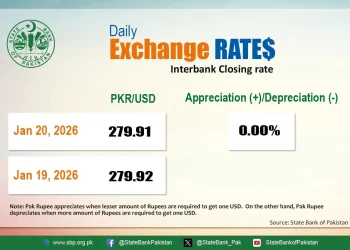

The ringgit, palm’s currency of trade, remained unchanged against the U.S dollar.

Malaysian crude palm oil futures are expected to average slightly lower in 2026 than last year, with stronger supply from major producers and subdued biofuel demand putting downward pressure on prices, a Reuters poll showed.