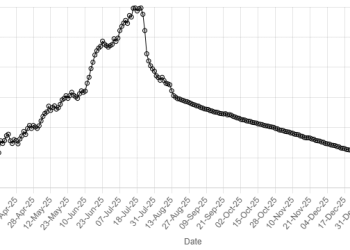

Oil prices rebounded on Friday after US President Donald Trump renewed threats against major Middle Eastern producer Iran, raising concerns of military action that could disrupt supplies.

Brent crude futures for March rose 29 cents, or 0.5%, to $64.35 a barrel.

US West Texas Intermediate crude also climbed 29 cents or 0.7% to $59.65 a barrel as of 0751 GMT.

Both contracts slumped about 2% on Thursday. They rebounded after Trump told reporters aboard Air Force One the US has an “armada” heading toward Iran but hoped he would not have to use it, as he renewed warnings to Tehran against killing protesters or restarting its nuclear program.

Warships including an aircraft carrier and guided missile destroyers will arrive in the Middle East in the coming days, a US official said.

Iran is the fourth-largest producer in the Organization of the Petroleum Exporting Countries and a major exporter to China, the world’s second-largest oil consumer.

Brent and WTI are set for weekly gains of about 0.6% after prices climbed earlier in the week on Trump’s threats to invade Greenland, potentially destabilising the trans-Atlantic alliance, but dropped on Thursday as he pulled back on any military action.

Trump said Denmark, which controls the Arctic island, NATO and the US had reached a deal that would allow “total access” to Greenland.

Prices also softened as bearish government data showed stockpiles in the US, the world’s biggest oil user, climbing last week amid slowing fuel demand.

US Energy Information Administration data released on Thursday said crude inventories climbed by 3.6 million barrels for the week ending January 16, more than the 1.1-million-barrel rise predicted by analysts in a Reuters poll.

This also exceeded the 3-million-barrel build that market sources said the American Petroleum Institute (API) trade group reported on Wednesday.