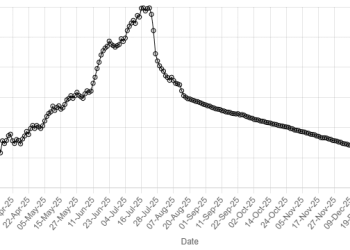

Bullish momentum returned to the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 Index closing above the 189,000 level on Friday.

The trading session commenced on an optimistic note and maintained a positive momentum throughout the day. Buying intensified during the second half of the trading session, pushing the KSE-100 to an intra-day high of 189,566.64.

At close, the benchmark index settled at 189,166.82, a gain of 1,478.66 points or 0.79%.

“Range bound activity was observed during the first half of trading session, however rally was observed in the second half largely led by FFC on investor optimism on earnings and payout in their upcoming board meeting for Annual Financial result for the year ended December 31, 2025,” brokerage house Topline Securities said in its post-market report.

Top positive contribution to the index came from FFC, EFERT, POL, HUBC and ENGROH, as they cumulatively contributed 2,206 points to the index, it added.

KSE-100 Index gained 2.2% on week-on-week (WoW) basis.

“This weekly gain can be accredited to investor’s expectation of cut in policy rate in monetary policy meeting on Monday, January 26. Further decline in yields in T-Bill auction held during the week, also provided stimulus to investor sentiment,” Topline said.

“Going forward, all eyes are on the Monetary Policy meeting scheduled for Monday…with the market expecting a 50–100bps rate cut. The decision is likely to set the market’s near-term direction,” Ali Najib, Deputy Head of Trading, Arif Habib Ltd said in a commentary.

The State Bank of Pakistan (SBP) is expected to reduce the policy rate in its upcoming Monetary Policy Committee (MPC) meeting scheduled to be held on January 26, 2026, on account of easing inflation, external stability and falling bond yields.

On Thursday, the Pak-Qatar General Takaful Limited (PKGTL) – the country’s first initial public offering (IPO) of the year 2026 – created history by recording “the highest oversubscription” of 21 times in the rupee term at the PSX.

On Thursday, PSX staged a modest recovery as select buying helped the market regain lost ground following the previous session’s sharp sell-off. Sentiment improved across most segments, allowing benchmark indices to close higher by the end of the session. The benchmark KSE-100 Index rose by 654.90 points, or 0.35%, to close at 187,688.16 points.

Internationally, stocks advanced in Asian trading on Friday after the Bank of Japan left benchmark interest rates on hold, while gold and silver surged to new peaks as the US dollar came under renewed pressure.

MSCI’s broadest index of Asia-Pacific shares outside Japan was last up 0.5%, while the Nikkei 225 climbed 0.3%. S&P 500 e-mini futures fluctuated between gains and losses, trading up 0.2%.

The yen weakened 0.1% against the greenback after the BOJ’s decision, last trading at 158.61 yen per dollar.

Stocks on Wall Street on Thursday extended their rebound for a second day after US President Donald Trump walked back earlier threats of tariffs on European goods and ruled out taking control of Greenland by force. The S&P 500 climbed 0.5%, and the Nasdaq Composite rallied 0.9%.

Meanwhile, the Pakistani rupee registered slight improvement against the US dollar in the inter-bank market on Friday. At close, the local currency settled at 279.86, a gain of Re0.01 against the greenback.

Volume on the all-share index decreased to 877.56 million from 1,069.31 million recorded in the previous close. The value of shares rose to Rs58.59 billion from Rs49.15 billion in the previous session.

K-Electric Ltd was the volume leader with 141.54 million shares, followed by Cnergyico PK with 53.38 million shares, and Hascol Petrol with 42.14 million shares.

Shares of 478 companies were traded on Friday, of which 175 registered an increase, 264 recorded a fall, and 39 remained unchanged.