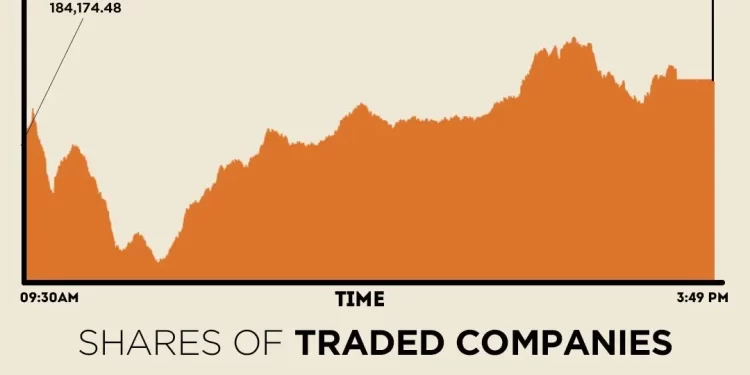

The Pakistan Stock Exchange (PSX) witnessed volatile trading on Monday, as its benchmark KSE-100 Index swayed in both directions before closing the day higher by nearly 900 points.

The KSE-100 witnessed heavy selling in the first half, hitting an intra-day low of 182,792.40.

However, sentiment improved in the latter half of the session, with the benchmark index hitting an intra-day high of 185,611.73.

At close, the benchmark index settled at 185,057.83, up by 883.35 points or 0.48%.

“The local bourse witnessed a seesaw session, juggling between cautious holds and selective buying throughout the day,” brokerage house Topline Securities said in its post-market report.

Select index heavyweights—UBL, ENGROH, SYS and FATIMA—offered some support, collectively contributing 753 points to the index. However, this was outweighed by selling pressure in FFC, LUCK, HBL, INDU, and AICL, which together shaved 416 points off the benchmark, Topline said.

“Investor sentiment improved following constructive geopolitical developments. Official statements from both the US and Iran indicated a willingness to pursue dialogue and avoid further escalation,” Ali Najib, Deputy Head of Trading, Arif Habib Ltd said.

During the previous week, PSX remained under sustained pressure, as the KSE-100 Index retreated sharply amid disappointment over monetary policy, heightened geopolitical tensions and weaker-than-expected corporate earnings, before staging a strong rebound in the final session on easing external risks and government support measures. The KSE-100 Index closed the week at 184,174 points, registering a week-on-week decline of 4,992 points or 2.6%.

Pakistan’s headline inflation clocked in at 5.8% on a year-on-year (YoY) basis in January 2026, showed Pakistan Bureau of Statistics (PBS) data on Monday, a reading in line with the Ministry of Finance’s estimate of 5-6%.

The consumer price index (CPI) was recorded at 5.6% in December 2025. The CPI stood at 2.4% in January 2025.

On month-on-month (MoM) basis, it increased by 0.4% in January 2026 as compared to a decrease of 0.4% in the previous month and an increase of 0.2% in January 2025.

Internationally, Asian shares mostly followed Wall Street futures into the red on Monday as chaotic trading in precious metals made for a nervous start to a week that is packed with corporate earnings, central bank meetings and major economic data.

Silver lost another 5% at one stage, as Friday’s 30% plunge squeezed leveraged positions in what had become a very crowded trade. Dealers also said pressure on the UBS SDIC silver futures fund in China added to the rout.

Oil prices fell around 3% as President Donald Trump said over the weekend Iran was “seriously talking” with Washington, perhaps lessening the risk of a US military strike on the country.

The jitters saw MSCI’s broadest index of Asia-Pacific shares outside Japan sink 1.7%, while South Korea shed 2.2%.

Chinese blue chips were flat, with falls in gold indexes.

Meanwhile, the Pakistani rupee posted marginal gain against the US dollar in the inter-bank market on Monday. At close, the local currency settled at 279.76, a gain of Re0.01 against the greenback.

Volume on the all-share index decreased to 740.09 million from 805.14 million recorded in the previous close. The value of shares declined to Rs42.20 billion from Rs50.83 billion in the previous session.

F. Nat.Equities was the volume leader with 191.18 million shares, followed by Hascol Petrol with 51.51 million shares, and K-Electric Ltd with 38.31 million shares.

Shares of 487 companies were traded on Monday, of which 214 registered an increase, 222 recorded a fall, and 51 remained unchanged.