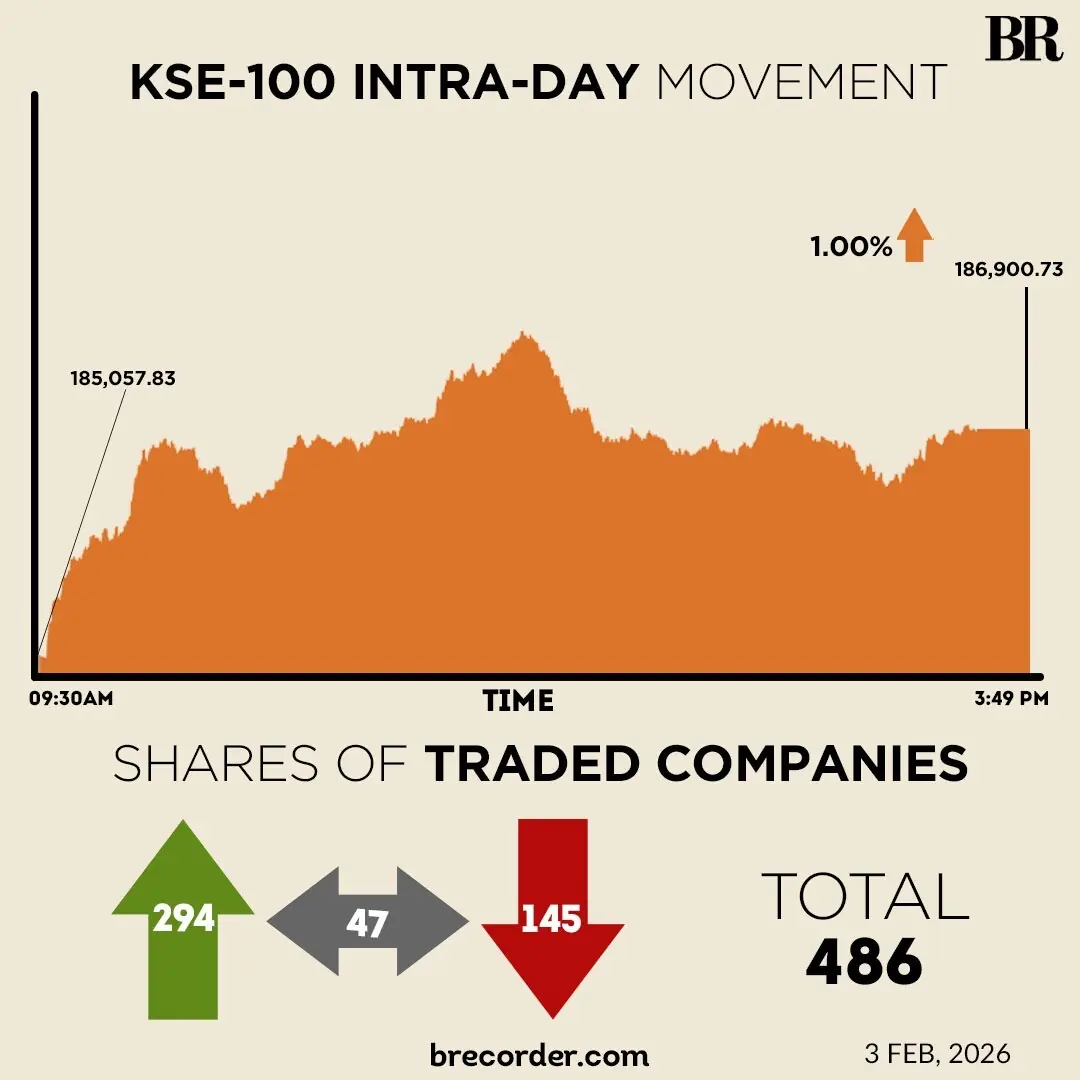

Buying momentum continued at the Pakistan Stock Exchange (PSX) as the benchmark KSE-100 Index closed higher by 1% on Tuesday.

The KSE-100 started the session with a positive sentiment that persisted till the end.

At close, the benchmark index settled at 186,900.74, up by 1,842.91 points or 1%.

“The upbeat tone of the market was largely attributed to sustained buying by local institutions, as highlighted by yesterday’s data from the National Clearing Company, reinforcing confidence and underpinning the day’s positive close,” brokerage house Topline Securities said in its post-market report.

On the index front, FFC, UBL, ENGROH, MEBL, MEBL, and SYS emerged as the top contributors, collectively adding 734 points to the benchmark, it added.

Meanwhile, Ali Najib, Deputy Head of Trading, Arif Habib Ltd said investor sentiment was buoyed by record goods exports exceeding $3 billion, underscoring continued improvement on the macroeconomic front.

“Additionally, the UAE rolled over $2 billion for one month, as Pakistan seeks to renegotiate the terms and tenure of two $1 billion loans,” he said.

On Monday, the PSX witnessed volatile trading, as the KSE-100 swayed in both directions before closing the day higher by nearly 900 points. At close, the benchmark index settled at 185,057.83, up by 883.35 points or 0.48%.

The stock market did not react negative to the news that US President Donald Trump had agreed on a trade deal with India that slashed US tariffs on Indian goods to 18% – 1% lower than Pakistan’s 19% – from previously 50% in exchange for New Delhi lowering trade barriers, stopping its purchases of Russian oil and buying oil instead from the US and potentially Venezuela.

Internationally, gold and Asian stocks were on the rebound on Tuesday as trade took a calmer tone after wild swings in metals markets, with the mood helped overnight by a sharp jump in US factory activity.

Japan’s Nikkei jumped 2.5% to recoup Monday losses and South Korea’s KOSPI rose 4%.

Futures pointed to a recovery in Hong Kong while S&P 500 futures were up 0.3% with traders eyeing a busy few sessions of earnings.

Investors were looking ahead to a central bank meeting in Australia later on Tuesday, where a strong jobs market and an unexpectedly hot fourth-quarter inflation reading have the market betting on a 25 basis point rate hike.

Australian shares were up 1.3% in early trade and the Aussie dollar , which has been bumpy but logged its largest monthly rise in three years in January, was firm at $0.6958.

Gold, silver, stocks and the dollar have all whipsawed since US President Donald Trump’s nomination of Kevin Warsh to lead the Federal Reserve sent metal prices tumbling.

Gold was up 3% in the Asia morning to $4,800 an ounce, a bounce of nearly 9% from Monday lows. Silver traded 5% higher to $83.34 an ounce.

Warsh is seen shrinking the Fed’s balance sheet, pushing up bond yields, which is negative for precious metals that pay no income.

Meanwhile, the Pakistani rupee posted marginal gain against the US dollar in the inter-bank market on Tuesday. At close, the local currency settled at 279.75, a gain of Re0.01 against the greenback.

Volume on the all-share index increased to 848.56 million from 740.09 million recorded in the previous close. The value of shares rose to Rs50.02 billion from Rs42.20 billion in the previous session.

K-Electric Ltd was the volume leader with 99.51 million shares, followed by F. Nat.Equities with 91.35 million shares, and B.O.Punjab with 86.29 million shares.

Shares of 486 companies were traded on Tuesday, of which 294 registered an increase, 145 recorded a fall, and 47 remained unchanged.