Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”, “13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”, “05-May-25”, “06-May-25”, “07-May-25”, “08-May-25”, “09-May-25”, “12-May-25”, “13-May-25”, “14-May-25”, “15-May-25”, “16-May-25”, “19-May-25”, “20-May-25”, “21-May-25”, “22-May-25”, “23-May-25”, “26-May-25”, “27-May-25”, “29-May-25”, “30-May-25”, “02-Jun-25”, “03-Jun-25”, “04-Jun-25”, “05-Jun-25”, “10-Jun-25”, “11-Jun-25”, “12-Jun-25”, “13-Jun-25”, “16-Jun-25”, “17-Jun-25”, “18-Jun-25”, “19-Jun-25”, “20-Jun-25”, “23-Jun-25”, “24-Jun-25”, “25-Jun-25”, “26-Jun-25”, “27-Jun-25”, “30-Jun-25”, “02-Jul-25”, “03-Jul-25”, “04-Jul-25”, “07-Jul-25”, “08-Jul-25”, “09-Jul-25”, “10-Jul-25”, “11-Jul-25”, “14-Jul-25”, “15-Jul-25”, “16-Jul-25”, “17-Jul-25”, “18-Jul-25”, “21-Jul-25”, “22-Jul-25”, “23-Jul-25”, “24-Jul-25”, “25-Jul-25”, “28-Jul-25”, “29-Jul-25”, “30-Jul-25”, “31-Jul-25”, “01-Aug-25”, “04-Aug-25”, “05-Aug-25”, “06-Aug-25”, “07-Aug-25”, “08-Aug-25”, “11-Aug-25”, “12-Aug-25”, “13-Aug-25”, “15-Aug-25”, “18-Aug-25”, “19-Aug-25”, “20-Aug-25”, “21-Aug-25”, “22-Aug-25”, “25-Aug-25”, “26-Aug-25”, “27-Aug-25”, “28-Aug-25”, “29-Aug-25”, “01-Sep-25”, “02-Sep-25”, “03-Sep-25”, “04-Sep-25”, “05-Sep-25”, “08-Sep-25”, “09-Sep-25”, “10-Sep-25”, “11-Sep-25”, “12-Sep-25”, “15-Sep-25”, “16-Sep-25”, “17-Sep-25”, “18-Sep-25”, “19-Sep-25”, “21-Sep-25”, “22-Sep-25”, “23-Sep-25”, “24-Sep-25”, “25-Sep-25”, “26-Sep-25”, “29-Sep-25”, “30-Sep-25”, “01-Oct-25”, “02-Oct-25”, “03-Oct-25”, “06-Oct-25”, “07-Oct-25”, “08-Oct-25”, “09-Oct-25”, “10-Oct-25”, “13-Oct-25”, “14-Oct-25”, “15-Oct-25”, “16-Oct-25”, “17-Oct-25”, “20-Oct-25”, “21-Oct-25”, “22-Oct-25”, “23-Oct-25”, “24-Oct-25”, “27-Oct-25”, “28-Oct-25”, “29-Oct-25”, “30-Oct-25”, “31-Oct-25”, “03-Nov-25”, “04-Nov-25”, “05-Nov-25”, “06-Nov-25”, “07-Nov-25”, “10-Nov-25”, “11-Nov-25”, “12-Nov-25”, “13-Nov-25”, “14-Nov-25”, “17-Nov-25”, “18-Nov-25”, “19-Nov-25”, “20-Nov-25”, “21-Nov-25”, “24-Nov-25”, “25-Nov-25”, “26-Nov-25”, “27-Nov-25”, “28-Nov-25”, “01-Dec-25”, “02-Dec-25”, “03-Dec-25”, “04-Dec-25”, “05-Dec-25”, “08-Dec-25”, “09-Dec-25”, “10-Dec-25”, “11-Dec-25”, “12-Dec-25”, “15-Dec-25”, “16-Dec-25”, “17-Dec-25”, “18-Dec-25”, “19-Dec-25”, “22-Dec-25”, “23-Dec-25”, “24-Dec-25”, “26-Dec-25”, “29-Dec-25”, “30-Dec-25”, “31-Dec-25”, “02-Jan-26”, “05-Jan-26”, “06-Jan-26”, “07-Jan-26”, “08-Jan-26”, “09-Jan-26”, “12-Jan-26”, “13-Jan-26”, “14-Jan-26”, “15-Jan-26”, “16-Jan-26”, “19-Jan-26”, “20-Jan-26”, “21-Jan-26”, “22-Jan-26”, “23-Jan-26”, “26-Jan-26”, “27-Jan-26”, “28-Jan-26”, “29-Jan-26”, “30-Jan-26”, “02-Feb-26”, “03-Feb-26”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06, 281.22, 281.37, 281.47, 281.52, 281.71, 281.57, 281.67, 281.72, 281.61, 281.66, 281.77, 281.92, 281.97, 282.06, 281.97, 282.06, 282.17, 282.07, 282.02, 281.97, 282.12, 282.22, 282.17, 282.21, 282.47, 282.67, 282.96, 283.17, 283.41, 283.55, 283.64, 283.70, 283.87, 283.77, 283.72, 283.67, 283.72, 283.76, 283.95, 283.86, 283.97, 284.22, 284.36, 284.47, 284.56, 284.46, 284.72, 284.67, 284.96, 284.97, 284.87, 284.95, 284.97, 284.76, 284.22, 283.45, 283.21, 283.05, 282.95, 282.87, 282.72, 282.66, 282.57, 282.67, 282.56, 282.47, 282.45, 282.42, 282.22, 282.06, 282.01, 281.96, 281.95, 281.92, 281.90, 281.87, 281.86, 281.83, 281.8, 281.77, 281.75, 281.72, 281.71, 281.67, 281.65, 281.62, 281.61, 281.60, 281.56, 281.55, 281.52, 281.51, 281.50, 281.47, 281.46, 281.45, 281.46, 281.42, 281.43, 281.41, 281.37, 281.35, 281.32, 281.31, 281.27, 281.26, 281.25, 281.22, 281.21, 281.20, 281.17, 281.16, 281.15, 281.12, 281.11, 281.10, 281.07, 281.06, 281.05, 281.03, 281.02, 281.01, 280.97, 280.96, 280.92, 280.91, 280.90, 280.87, 280.86, 280.85, 280.82, 280.81, 280.78, 280.77, 280.76, 280.72, 280.71, 280.67, 280.66, 280.66, 280.65, 280.62, 280.61, 280.57, 280.56, 280.55, 280.52, 280.51, 280.47, 280.46, 280.45, 280.42, 280.41, 280.40, 280.37, 280.36, 280.32, 280.31, 280.30, 280.27, 280.26, 280.25, 280.22, 280.21, 280.20, 280.17, 280.16, 280.15, 280.12, 280.11, 280.10, 280.07, 280.06, 280.05, 280.02, 280.01, 280.0, 279.97, 279.96, 279.95, 279.92, 279.91, 279.90, 279.87, 279.86, 279.85, 279.82, 279.81, 279.80, 279.77, 279.76, 279.75

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

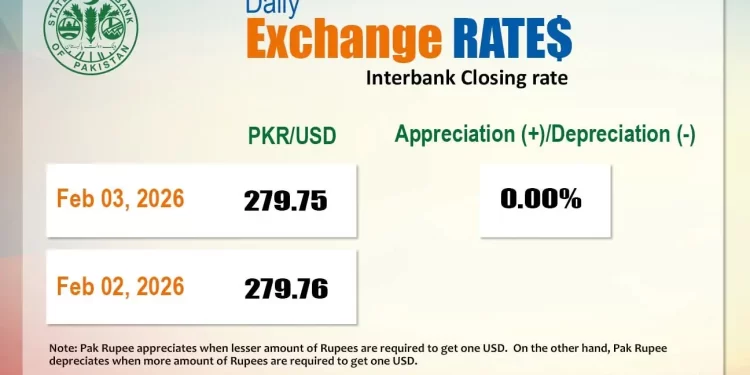

The Pakistani rupee posted marginal gain against the US dollar in the inter-bank market on Tuesday.

At close, the local currency settled at 279.75, a gain of Re0.01 against the greenback.

On Monday, the domestic currency closed at 279.76.

Internationally, the dollar held gains on Tuesday as positive economic readings and shifting expectations for Federal Reserve policy outweighed concerns about another US government shutdown.

The Australian dollar rose ahead of an expected rate hike by the nation’s central bank, the first of three major central bank decisions this week.

The yen remained lower as Japanese Finance Minister Satsuki Katayama tried to play down comments from the prime minister that there were benefits to a weaker currency.

The greenback gained overnight after US manufacturing data from the Institute for Supply Management (ISM) showed a return to growth, though a key jobs report may be delayed due to an impasse in Washington. Geopolitical tensions ratcheted down as the US reached a trade deal with India and said nuclear talks will resume with Iran.

“The domestic story coming from the US was also supportive for the dollar in terms of that big surprise from the ISM,” Rodrigo Catril, a currency strategist at National Australia Bank, said on a podcast.

“The Indian story is interesting, but really it’s about this idea that the tensions between the US and Iran are seemingly easing, and all this pressure and threats that President Trump has imposed has brought Iran to the table,” he added.

The dollar index , which measures the greenback against a basket of currencies, was little changed at 97.50, after a two-day advance.

The euro was up 0.1% at $1.1804, and the yen tacked on 0.1% to 155.53 per dollar.

Oil prices, a key indicator of currency parity, steadied on Tuesday, after falling over 4% in the previous session, as market participants considered the global supply outlook and the possibility of a de-escalation in US-Iran tensions.

Brent crude futures gained 17 cents to $66.47 per barrel by 1217 GMT, while US West Texas Intermediate crude was at $62.38 a barrel, up 24 cents. Earlier in the session, Brent and WTI fell to $65.19 a barrel and $61.12 a barrel, respectively, both the lowest in a week.

Inter-bank market rates for dollar on Tuesday

BID Rs 279.75

OFFER Rs 279.95

Open-market movement

In the open market, the PKR remained unchanged for both buying and selling against USD, closing at 280.24 and 280.80, respectively.

Against Euro, the PKR gained 1.61 rupee for buying and 1.46 rupee for selling, closing at 330.55 and 333.74, respectively.

Against UAE Dirham, the PKR gained 3 paise for buying and 4 paise for selling, closing at 76.50 and 77.19, respectively.

Against Saudi Riyal, the PKR lost 2 paise for buying and remained unchanged for selling, closing at 74.82 and 75.37, respectively.

Open-market rates for dollar on Tuesday

BID Rs 280.24

OFFER Rs 280.80