MUMBAI: India’s government bond rout deepened on Monday as investors trimmed positions ahead of a hefty state debt sale, after the central bank’s policy decision offered no liquidity support and dashed hopes it would underpin demand.

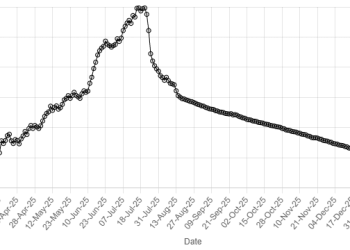

The benchmark 6.48% 2035 bond yield halted at 6.7559%, versus 6.7363% on Friday, extending its climb after its biggest single-session jump in six months.

Bond yields move inversely to prices.

The 10-year yield has risen 11 basis points in the last two sessions, and is up about 17 basis points since the start of 2026.

Traders jettisoned government bonds as sentiment soured after the Reserve Bank of India skipped announcing additional liquidity operations in its policy decision on Friday.

The market had been looking for anything that would help absorb New Delhi’s record borrowing plan while banks pressed for a change in liquidity rules to ease deposit shortfalls.

The selloff extended on Monday as Indian states upped the weekly borrowing to 486.15 billion rupees ($5.36 billion), 60 billion rupees higher than planned and the largest issuance of the fiscal year.

Selling was concentrated in longer-dated bonds, while traders found value at the front-end of the yield curve amid improving liquidity levels, pulling down yields on 1–3 year notes by 2–3 basis points.

With no fresh open market operations from the RBI and a large borrowing programme ahead, bonds are likely to stay under pressure, said Avnish Jain, CIO–fixed income at Canara Robeco Asset Management.

Focus is now on Thursday’s inflation data, with retail inflation likely rising for a third straight month to 2.4% in January, the first month of a new data series based on 2024 prices, according to a Reuters poll.

Rates

India’s shorter-duration overnight index swap rates eased on widening banking system liquidity.

The one-year OIS rate and the two-year rate fell 1.5 bps each to 5.5175% and 5.69% respectively.

The five-year OIS rate was steady at 6.18%.