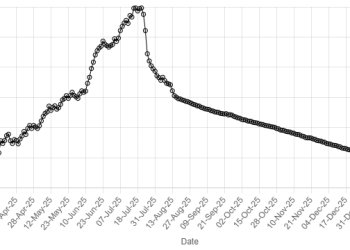

Positive momentum was observed at the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 Index gaining nearly 600 points during the opening minutes of trading on Tuesday.

At 9:40am, the benchmark index was hovering at 182,916.86, an increase of 576.48 points or 0.32%.

Buying momentum was observed in key sectors, including automobile assemblers, cement, fertiliser, oil and gas exploration companies, OMCs, power generation and refinery. Index-heavy stocks, including HUBCO, MARI, POL, PSO, SSGC, SNGPL, MCB and UBL, traded in the green.

Despite clear signs of improving macroeconomic stability, Pakistan’s economic outlook remains vulnerable to a range of domestic and external risks, the State Bank of Pakistan (SBP) said on Monday, calling for sustained policy discipline and deep structural reforms.

On Monday, PSX remained under pressure as sustained institutional selling, weakness in index-heavy stocks, and technical adjustments pushed indices lower. The benchmark KSE-100 Index closed lower by 1,789.20 points, or 0.97%, settling at 182,340.38 points.

Internationally, Asian stocks advanced for a second day in early trading on Tuesday, led by an extended rally in Tokyo’s benchmark after Japanese Prime Minister Sanae Takaichi’s decisive election victory over the weekend.

MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.7%, while the Nikkei 225 jumped 2.8%, rising for a third consecutive day to a fresh peak. The yen also strengthened for a second day.

US equity futures cooled after a two-day rally, with S&P 500 e-mini futures down 0.1%, partially retracing gains on Wall Street overnight. On Monday, the S&P 500 rose 0.5%, and the Nasdaq Composite gained 0.9% as technology stocks found their footing following last week’s AI-sparked selloff.

With several critical US economic reports due for release this week, including delayed payrolls data, White House economic adviser Kevin Hassett said on Monday that job gains could be lower in the coming months as the Trump administration’s immigration policies slow labour growth and new AI tools boost productivity.

This is an intra-day update