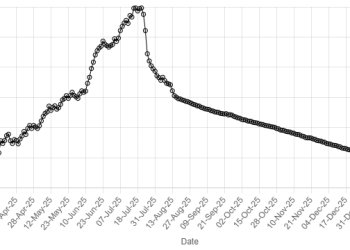

The Pakistan Stock Exchange (PSX) closed marginally lower on Tuesday, with the benchmark index closing with a loss of nearly 200 points as investors remained cautious amid the absence of fresh triggers.

During the trading session, the market witnessed intra-day volatility, touching a high of 183,216 points and a low of 181,499 points, reflecting a range-bound trading.

At close, the KSE-100 Index settled at 182,153.55, a decrease of 186.83 points or 0.10%.

“The local bourse blew hot and cold in today’s session as bulls failed to sustain early momentum,” brokerage house Topline Securities said in its post-market report.

Heavyweight selling weighed on the index, with HBL, TRG, KEL, AKBL, and BAFL jointly knocking off 461 points. Select buying in ENGROH, LUCK, FFC, and HUBC provided some cushion, contributing 738 points, though not enough to reverse the trend, it added.

The inflow of overseas workers’ remittances into Pakistan stood at $3.46 billion in January 2026, the State Bank of Pakistan (SBP) data showed on Tuesday.

Remittances increased by nearly 15.4% year-on-year (YoY), compared to $3.0 billion recorded in the same month last year. Monthly remittances were down 4% from $3.59 billion in December.

Pakistan’s economic outlook remains vulnerable to a range of domestic and external risks, the SBP said on Monday, calling for sustained policy discipline and deep structural reforms.

On Monday, PSX remained under pressure as sustained institutional selling, weakness in index-heavy stocks, and technical adjustments pushed indices lower. The benchmark KSE-100 Index closed lower by 1,789.20 points, or 0.97%, settling at 182,340.38 points.

Internationally, Asian stocks advanced for a second day in early trading on Tuesday, led by an extended rally in Tokyo’s benchmark after Japanese Prime Minister Sanae Takaichi’s decisive election victory over the weekend.

MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.7%, while the Nikkei 225 jumped 2.8%, rising for a third consecutive day to a fresh peak. The yen also strengthened for a second day.

US equity futures cooled after a two-day rally, with S&P 500 e-mini futures down 0.1%, partially retracing gains on Wall Street overnight. On Monday, the S&P 500 rose 0.5%, and the Nasdaq Composite gained 0.9% as technology stocks found their footing following last week’s AI-sparked selloff.

With several critical US economic reports due for release this week, including delayed payrolls data, White House economic adviser Kevin Hassett said on Monday that job gains could be lower in the coming months as the Trump administration’s immigration policies slow labour growth and new AI tools boost productivity.

Volume on the all-share index increased to 1,062.31 million from 931.36 million recorded in the previous close. The value of shares declined to Rs37.88 billion from Rs58.87 billion in the previous session.

K.Electric was the volume leader with 253.68 million shares, followed by Cnergyico PK with 189.38 million shares, and WorldCall Telecom with 117.05 million shares.

Shares of 482 companies were traded on Tuesday, of which 153 registered an increase, 280 recorded a fall, and 49 remained unchanged.