MUMBAI: The Indian rupee is expected to find support at the open on Wednesday from a fall in U.S. yields, though traders said it is unlikely to rise beyond 90.50 per dollar due to persistent importer hedging.

The one-month non-deliverable forward indicated the rupee will open in the 90.55-90.60 range versus the U.S. dollar, after settling 0.2% higher at 90.5775 in the previous session.

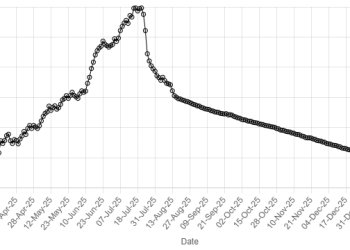

The rupee halted a two-day slide on Tuesday after finding support near the 90.70–90.80 region, a level that many traders consider crucial for maintaining the upbeat momentum driven by the US-India trade deal.

At the same time, traders pointed to persistent dollar demand from importers looking to hedge liabilities at current levels, with buying interest picking up further whenever the rupee rallies.

“It appears to me that there are layered (dollar) bids all through 90.10 to 90.40. That underlying demand makes it difficult for the rupee to sustainably break beyond 90.50 at this stage,” a currency trader at a bank said.

While the rupee advanced decisively beyond that mark in the immediate aftermath of the US–India trade deal, the move proved short-lived. The currency has been in the 90.04-90.84 range since the deal.

The drop in U.S. Treasury yields and a broadly softer dollar are likely to support the rupee at the open.

U.S. yields declined on Tuesday after a batch of economic data pointed to a cooling economy, potentially providing the Federal Reserve room to cut interest rates.

Retail sales were flat in December, undershooting expectations, while the Employment Cost Index, the broadest gauge of labor costs, rose less than estimated, reflecting softer labor demand.

“Stalling retail sales momentum at the end of 2025 highlights vulnerabilities, given the backdrop of a weak labour market and soft consumer sentiment,” ANZ Bank said in a note.