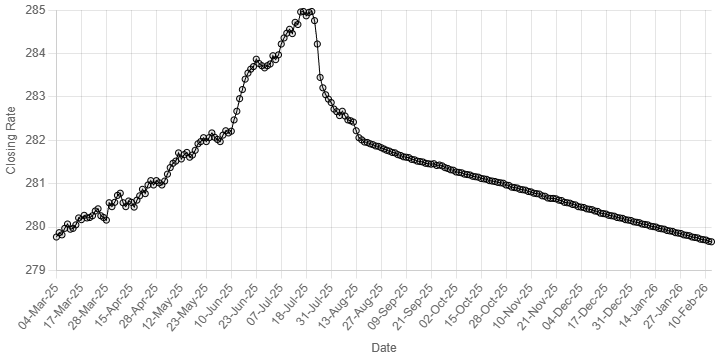

Rupee’s Performance Against US Dollar Since 04 March 2025

The Pakistani rupee posted marginal gain against the US dollar in the inter-bank market on Thursday.

At close, the local currency settled at 279.65, a gain of Re0.01 against the greenback.

On Wednesday, the local currency closed at 279.66, according to the State Bank of Pakistan (SBP).

On Thursday, (SBP) Governor Jameel Ahmad said the country’s economy is projected to grow between 3.75% and 4.75% in FY26, signalling a gradual recovery amid improving macroeconomic indicators.

SBP chief reiterated that Pakistan has regained macroeconomic stability and is moving towards sustainable growth.

Internationally, against the US dollar, the yen traded as strong as 152.55 on Wednesday, before steadying slightly below that at 153.05 per dollar on Thursday. The rebound is nascent – since the yen has been declining for years – but it has been big enough to turn heads in the market.

A stronger-than-expected US jobs report overnight briefly lifted the greenback. But traders are taking recent signs of US economic resilience as cues for a broader brightening in global growth and are laying bets on Japan as a likely winner.

The yen is up more than 2.6% since Prime Minister Sanae Takaichi’s Liberal Democratic Party swept to a landslide victory at Sunday’s election and a mood shift seems to be afoot as markets set aside fears about spending to focus on growth.

Moreover, oil prices edged up on Thursday morning as investors worried about escalating tensions between the US and Iran, on fears that any attacks on Tehran or shipping could lead to supply disruptions.

Brent crude oil futures were up 27 cents, or 0.39%, at $69.67 a barrel at 0350 GMT.

US West Texas Intermediate crude rose 29 cents, or 0.45%, to $64.92.

Both benchmarks settled higher on Wednesday.

Brent futures gained 0.87% and WTI gained more than 1.05%, as investor worries about US-Iran tensions overshadowed a build in US crude stocks.

Rupee’s Performance Against US Dollar Since 04 March 2025

The Pakistani rupee posted marginal gain against the US dollar in the inter-bank market on Thursday.

At close, the local currency settled at 279.65, a gain of Re0.01 against the greenback.

On Wednesday, the local currency closed at 279.66, according to the State Bank of Pakistan (SBP).

On Thursday, (SBP) Governor Jameel Ahmad said the country’s economy is projected to grow between 3.75% and 4.75% in FY26, signalling a gradual recovery amid improving macroeconomic indicators.

SBP chief reiterated that Pakistan has regained macroeconomic stability and is moving towards sustainable growth.

Internationally, against the US dollar, the yen traded as strong as 152.55 on Wednesday, before steadying slightly below that at 153.05 per dollar on Thursday. The rebound is nascent – since the yen has been declining for years – but it has been big enough to turn heads in the market.

A stronger-than-expected US jobs report overnight briefly lifted the greenback. But traders are taking recent signs of US economic resilience as cues for a broader brightening in global growth and are laying bets on Japan as a likely winner.

The yen is up more than 2.6% since Prime Minister Sanae Takaichi’s Liberal Democratic Party swept to a landslide victory at Sunday’s election and a mood shift seems to be afoot as markets set aside fears about spending to focus on growth.

Moreover, oil prices edged up on Thursday morning as investors worried about escalating tensions between the US and Iran, on fears that any attacks on Tehran or shipping could lead to supply disruptions.

Brent crude oil futures were up 27 cents, or 0.39%, at $69.67 a barrel at 0350 GMT.

US West Texas Intermediate crude rose 29 cents, or 0.45%, to $64.92.

Both benchmarks settled higher on Wednesday.

Brent futures gained 0.87% and WTI gained more than 1.05%, as investor worries about US-Iran tensions overshadowed a build in US crude stocks.