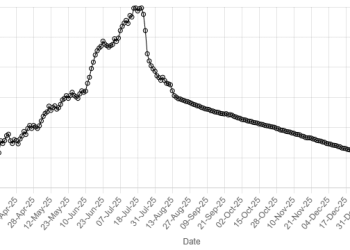

Rupee’s Performance Against US Dollar Since 04 March 2025

The Pakistani rupee registered marginal improvement against the US dollar, appreciaiting 0.01% in the inter-bank market on Friday.

At close, the local currency settled at 279.62, a gain of Re0.03 against the greenback.

On Thursday, the local currency closed at 279.65, according to the State Bank of Pakistan (SBP).

Globally, the yen was set for its best week in almost 15 months on Friday, having climbed steadily after Japanese Prime Minister Sanae Takaichi’s historic election win allayed investor worries about the nation’s fiscal health.

A resurgent yen has been the main focus for the foreign exchange market this week, particularly as its rise confounded initial expectations that a selloff in the currency could gather pace if Takaichi secured a strong mandate.

It was last steady at 152.86 per US dollar, but was set to gain nearly 3% for the week, which would mark its largest advance since November 2024.

Against the euro, the yen was similarly poised for a 2.3% weekly jump, its strongest performance in a year. It was also up roughly 2.8% against the British pound for the week, its largest rise since July 2024.

Additionally, oil prices slipped on Friday and were on track for a second weekly decline as concerns receded over the risks of a US-Iran conflict that could affect supply.

Brent crude oil futures were down 12 cents, or 0.2%, at $67.40 a barrel at 0831 GMT after falling 2.7% in the previous session.

US West Texas Intermediate (WTI) crude fell 13 cents, or 0.2%, to $62.71 after falling 2.8%. Brent prices are set to drop 0.8% this week, while WTI is set to fall 1.1%.

Prices gained earlier this week on concerns that the US could attack key Middle Eastern producer Iran over its nuclear programme.

Rupee’s Performance Against US Dollar Since 04 March 2025

The Pakistani rupee registered marginal improvement against the US dollar, appreciaiting 0.01% in the inter-bank market on Friday.

At close, the local currency settled at 279.62, a gain of Re0.03 against the greenback.

On Thursday, the local currency closed at 279.65, according to the State Bank of Pakistan (SBP).

Globally, the yen was set for its best week in almost 15 months on Friday, having climbed steadily after Japanese Prime Minister Sanae Takaichi’s historic election win allayed investor worries about the nation’s fiscal health.

A resurgent yen has been the main focus for the foreign exchange market this week, particularly as its rise confounded initial expectations that a selloff in the currency could gather pace if Takaichi secured a strong mandate.

It was last steady at 152.86 per US dollar, but was set to gain nearly 3% for the week, which would mark its largest advance since November 2024.

Against the euro, the yen was similarly poised for a 2.3% weekly jump, its strongest performance in a year. It was also up roughly 2.8% against the British pound for the week, its largest rise since July 2024.

Additionally, oil prices slipped on Friday and were on track for a second weekly decline as concerns receded over the risks of a US-Iran conflict that could affect supply.

Brent crude oil futures were down 12 cents, or 0.2%, at $67.40 a barrel at 0831 GMT after falling 2.7% in the previous session.

US West Texas Intermediate (WTI) crude fell 13 cents, or 0.2%, to $62.71 after falling 2.8%. Brent prices are set to drop 0.8% this week, while WTI is set to fall 1.1%.

Prices gained earlier this week on concerns that the US could attack key Middle Eastern producer Iran over its nuclear programme.