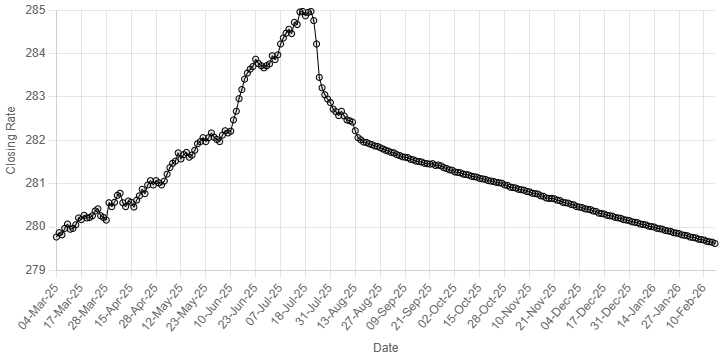

Rupee’s Performance Against US Dollar Since 04 March 2025

The Pakistani rupee registered marginal gain against the US dollar in the inter-bank market on Monday.

At close, the local currency settled at 279.61 against the greenback.

On Friday, the local currency closed at 279.62, according to the State Bank of Pakistan (SBP).

Internationally, the Japanese yen started the week on the back foot after strong gains last week on easing fiscal worries, while the US dollar was steady as soft inflation data boosted the case for interest rate cuts from the Federal Reserve later this year.

Liquidity is likely to be thin with markets in the US, China, Taiwan and South Korea closed for a holiday.

The yen eased 0.2% to 153.07 per U.S. dollar in early trading on Monday after climbing nearly 3% last week, its biggest weekly jump in about 15 months in the wake of Prime Minister Sanae Takaichi’s landslide election victory.

The US dollar was meanwhile headed for a weekly loss, pressured by a confluence of factors including strength in other currencies, as well as some doubts about the robustness of the US economy.

Against a basket of currencies, the greenback was little changed at 96.93, but was set to fall close to 0.8% for the week.

Overnight, data showed the number of Americans filing new applications for unemployment benefits decreased less than expected last week.

Oil prices, a key indicator of currency parity, rose slightly on Monday, with investors weighing the market implications of upcoming US-Iran talks aimed at de-escalating tensions against a backdrop of expected OPEC+ supply increases.

Brent crude futures gained 41 cents, or 0.6%, to $68.16 a barrel by 1508 GMT.

Inter-bank market rates for dollar on Monday

BID Rs 279.61

OFFER Rs 279.81

Open-market movement

In the open market, the PKR gained 2 paise for buying and remained unchanged for selling against USD, closing at 280.14 and 280.66, respectively.

Against Euro, the PKR gained 5 paise for buying and lost 6 paise for selling, closing at 331.84 and 334.86, respectively.

Against UAE Dirham, the PKR gained 7 paise for buying and 6 paise for selling, closing at 76.48 and 77.23, respectively.

Against Saudi Riyal, the PKR gained 10 paise for buying and 4 paise for selling, closing at 74.69 and 75.33, respectively.

Open-market rates for dollar on Monday

BID Rs 280.14

OFFER Rs 280.66

Rupee’s Performance Against US Dollar Since 04 March 2025

The Pakistani rupee registered marginal gain against the US dollar in the inter-bank market on Monday.

At close, the local currency settled at 279.61 against the greenback.

On Friday, the local currency closed at 279.62, according to the State Bank of Pakistan (SBP).

Internationally, the Japanese yen started the week on the back foot after strong gains last week on easing fiscal worries, while the US dollar was steady as soft inflation data boosted the case for interest rate cuts from the Federal Reserve later this year.

Liquidity is likely to be thin with markets in the US, China, Taiwan and South Korea closed for a holiday.

The yen eased 0.2% to 153.07 per U.S. dollar in early trading on Monday after climbing nearly 3% last week, its biggest weekly jump in about 15 months in the wake of Prime Minister Sanae Takaichi’s landslide election victory.

The US dollar was meanwhile headed for a weekly loss, pressured by a confluence of factors including strength in other currencies, as well as some doubts about the robustness of the US economy.

Against a basket of currencies, the greenback was little changed at 96.93, but was set to fall close to 0.8% for the week.

Overnight, data showed the number of Americans filing new applications for unemployment benefits decreased less than expected last week.

Oil prices, a key indicator of currency parity, rose slightly on Monday, with investors weighing the market implications of upcoming US-Iran talks aimed at de-escalating tensions against a backdrop of expected OPEC+ supply increases.

Brent crude futures gained 41 cents, or 0.6%, to $68.16 a barrel by 1508 GMT.

Inter-bank market rates for dollar on Monday

BID Rs 279.61

OFFER Rs 279.81

Open-market movement

In the open market, the PKR gained 2 paise for buying and remained unchanged for selling against USD, closing at 280.14 and 280.66, respectively.

Against Euro, the PKR gained 5 paise for buying and lost 6 paise for selling, closing at 331.84 and 334.86, respectively.

Against UAE Dirham, the PKR gained 7 paise for buying and 6 paise for selling, closing at 76.48 and 77.23, respectively.

Against Saudi Riyal, the PKR gained 10 paise for buying and 4 paise for selling, closing at 74.69 and 75.33, respectively.

Open-market rates for dollar on Monday

BID Rs 280.14

OFFER Rs 280.66