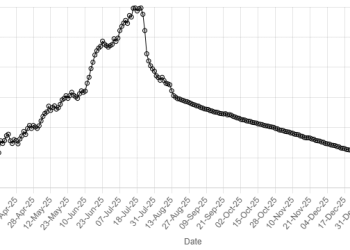

Massive selling pressure was observed at the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 Index shedding 5,150 points or 2.87% during trading on Monday.

This was KSE-100’s third-largest day-to-day decline point-wise, said Al-Habib Capital Markets Limited, a subsidiary of Bank Al Habib Limited.

During trading, the benchmark index opened under pressure and quickly slipped below the 179,000 level, reflecting strong early selling.

Selling pressure intensified in the latter half as the index dropped below 176,000, further accelerating the decline.

Around the final hours of trading, the index attempted a nominal rebound after dropping to an intra-day low of 173,574.26, but the recovery remained shallow.

At close, the benchmark index settled at 174,453.93, a decrease of 5,149.80 points or 2.87%.

“The sharp sell-off in the KSE-100 today has largely been driven by massive redemptions, with heavy selling pressure from a few large mutual funds acting as the primary trigger,” Waqas Ghani, Head of Research at JS Global, told media.

Meanwhile, Saad Hanif, Head of Research at Ismail Iqbal Securities, attributed the decline to foreign selling.

Topline Securities said the steep drop was primarily driven by foreign outflows, as reflected in the previous session’s data.

“Additionally, escalating political noise further dampened investor confidence, intensifying the bearish momentum.”

Index-heavy constituents—including Fauji Fertilizer Company, United Bank Limited, Engro Holdings, Habib Bank Limited, and Bank AL Habib Limited—emerged as the primary laggards, collectively eroding 1,680 points from the benchmark during the session, Topline said.

Federal Finance Minister Muhammad Aurangzeb on Monday said the government remained committed to accelerating the privatisation process, saying that more state-owned enterprises (SOEs) would be gradually privatised.

During the previous week, the PSX came under sustained selling pressure as heightened political uncertainty and deteriorating security conditions, particularly in Balochistan, undermined investor confidence, overshadowing otherwise supportive macroeconomic developments and strong external inflows. The KSE-100 Index closed the week at 179,603.73 points, registering a decline of 4,525.85 points or 2.5% week-on-week.

Globally, Asian shares were quietly consolidating recent hefty gains on Monday as holidays made for thin trading, and dismal economic data out of Japan took some of the heat out of that booming market.

China, South Korea, Taiwan and the United States were among the centres off, leaving currencies, commodities and bonds all becalmed.

The major data of the week are not out until Friday, when surveys of global manufacturing hit and the US reports gross domestic product for the fourth quarter.

Median forecasts are for annualised growth of 3.0%, down from 4.4% the previous quarter but still solid.

Investors pushed Japan’s Nikkei up 0.2%, following a 5% rise last week. MSCI’s broadest index of Asia-Pacific shares outside Japan firmed 0.1%.

South Korea’s tech-heavy market surged 8.2% last week, while Taiwan climbed almost 6% for the week.

Meanwhile, the Pakistani rupee registered marginal gain against the US dollar in the inter-bank market on Monday. At close, the local currency settled at 279.61 against the greenback.

Volume on the all-share index increased to 773.29 million from 708.97 million recorded in the previous close.

The value of shares rose to Rs46.24 billion from Rs38.89 billion in the previous session.

K-Electric Ltd was the volume leader with 63.83 million shares, followed by WorldCall Telecom with 62.24 million shares, and B.O.Punjab with 56.17 million shares.

Shares of 487 companies were traded on Monday, of which 65 registered an increase, 378 recorded a fall, while 44 remained unchanged.