Most stock markets in the Gulf ended lower on Tuesday as investors remained cautious amid U.S.–Iran nuclear talks, while Iran held a naval drill near the Strait of Hormuz.

Washington and Tehran began indirect talks in Geneva on Tuesday, focusing on their long-running nuclear dispute amid a U.S. military buildup in the Middle East. Iran’s supreme leader warned on Tuesday that any U.S. attempt to depose his government would fail.

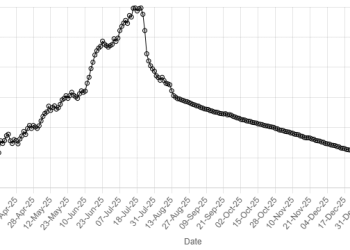

Saudi Arabia’s benchmark index dropped 0.8%, with Al Rajhi Bank losing 1% and the country’s biggest lender by assets, Saudi National Bank, retreating 1.2%.

Oil giant Saudi Aramco was down 0.6%.

Crude prices, a catalyst for the Gulf’s financial markets, were largely stable as investors braced for nuclear talks between Iran and the U.S., and trilateral U.S.-Ukraine-Russia peace talks, both taking place in Geneva.

Iran began a military drill on Monday in the Strait of Hormuz, a critical international shipping lane and key oil export route for Gulf Arab states, which have been urging a diplomatic solution to end the long-running dispute.

Meanwhile, the U.S. military is making preparations for the possibility of weeks-long operations against Iran if President Donald Trump orders an attack, Reuters reported on Saturday, citing two U.S. officials.

The Saudi stock market extended its correction this week, trading lower as geopolitical concerns dampened sentiment, said Daniel Takieddine, co-founder and CEO of Sky Links Capital Group.

“As a market closely tied to energy dynamics, it remains particularly sensitive to both the general risk-off environment and fluctuations in oil prices, both of which will be significantly influenced by the results of the US-Iran talks.”

Dubai’s main share index was down 0.3%, hit by a 2.2% slide in sharia-compliant lender Dubai Islamic Bank .

In Abu Dhabi, the index finished flat%.

The Qatari index declined 0.6%, dragged down by a 2.6% fall in the Gulf’s biggest lender by assets, Qatar National Bank .

Outside the Gulf, Egypt’s blue-chip index gained 0.7%, with Talaat Moustafa Holding advancing 4%.

Saudi Arabia | dropped 0.8% to 11,098 |

Abu Dhabi | was flat at 10,624 |

Dubai | lost 0.3% to 6,684 |

Qatar | was down 0.6% to 11,363 |

Egypt | added 0.5% to 51,735 |

Bahrain | gained 0.2% to 2,054 |

Oman | was up 0.3% to 7,307 |

Kuwait | increased 0.2% to 9,279 |