SEOUL: Round-up of South Korean financial markets:

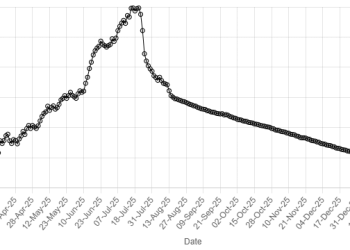

South Korean equity benchmark rose to a record on Friday after brokerages rallied on the record-breaking performance of the local stock market that doubled in value in the past year.

The won weakened, while the benchmark bond yield fell.

The benchmark KOSPI was up 72.98 points, or 1.29%, at 5,750.23 as of 0216 GMT. For the week, the index is up 4.40%, after rising more than 8% last week. It has risen 36.45% so far this year.

Shares of Daishin Securities, Samsung Securities gained 7% and 4.30% respectively, while Mirae Asset Securities is up 3.40%.

Among index heavyweights, chipmaker Samsung Electronics fell 0.37%, while peer SK Hynix gained 3.02%.

Battery maker LG Energy Solution slid 0.62%.

Hyundai Motor and sister automaker Kia Corp were down 1.07% and 0.29%, respectively. Steelmaker POSCO Holdings added 0.64%, while drugmaker Samsung BioLogics rose 0.64%.

Of the total 924 traded issues, 505 shares advanced, while 377 declined. Foreigners were net sellers of shares worth 681.5 billion won.

The won was quoted at 1,449.4 per dollar on the onshore settlement platform, 0.03% lower than its previous close at 1,448.9.

The currency has weakened 0.7% against the dollar so far this year.

In money and debt markets, March futures on three-year treasury bonds gained 0.13 basis point to 105.15.

The most liquid three-year Korean treasury bond yield fell by 2.4 bps to 3.151%, while the benchmark 10-year yield fell by 4.1 bps to 3.544%. ‑Reuters