The Securities and Exchange Commission of Pakistan (SECP) has begun transitioning from physical share certificates to electronic (book-entry) form through the Central Depository System (CDS), operated by the Central Depository Company (CDC).

“The move will eliminate risks associated with paper certificates, enable faster and more secure share transfers, and improve transparency of ownership records,” SECP said in a press statement on Friday.

Currently, unlisted companies rely on physical share certificates, which are susceptible to loss, damage, theft, and forgery. These vulnerabilities have led to numerous ownership disputes currently pending before courts, SECP noted.

Transitioning to digital shares in book-entry form would ensure secure, transparent, and tamper-proof shareholding records, significantly reducing the risk of fraudulent transfers and related litigation, it said.

Moreover, electronic shares will also reduce paperwork and administrative costs while enabling faster transfers, quicker settlement, and accurate real-time records of ownership, added the statement

“Book-entry shares can be pledged as collateral for financing, improving access to credit and supporting business growth.

The centralised electronic system will further enhance regulatory oversight, increase transparency of ownership structures, and strengthen corporate governance among unlisted companies.”

READ MORE: SECP registers 3,881 new companies in January

Under this phase, all existing unlisted companies with physical shares will be required to convert their shares into book-entry form before undertaking any share-related transaction.

“Thereafter, all transfers, allotments, and other share transactions must be executed through the CDS, and all parties involved must maintain their holdings in electronic form. The Commission will issue a formal notification in this regard.”

The SECP has already made it mandatory for newly incorporated unlisted companies to issue shares exclusively in electronic form, with physical share certificates no longer permitted.

For existing companies, the forthcoming notification will require conversion of physical shares into electronic form prior to undertaking transactions such as transfers, allotments, rights issues, bonus issues, buybacks, or any change in shareholding structure.

This phased approach enables legacy companies to continue routine operations while gradually transitioning to full digitisation, the press release said.

“The SECP has also approved comprehensive procedures for induction into the CDS, including eligibility criteria, documentation requirements, verification mechanisms, and applicable tariffs, to ensure a smooth, secure, and orderly transition.”

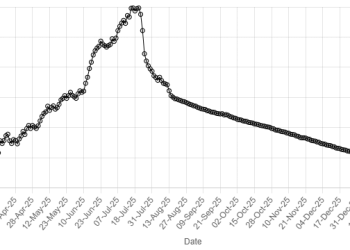

American Dollar Exchange Rate

American Dollar Exchange Rate