LONDON: Copper surged to record highs on Monday as a recent rally triggered by short covering created momentum for speculators and funds to bet on higher prices of the metal used in the power and construction industries.

Short positions can be producers hedging their output, but often they are bets on lower prices made by traders and funds.

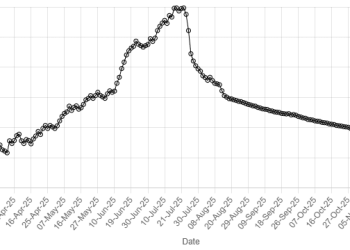

Benchmark copper on the London Metal Exchange (LME) was up 2.7% at $10,958 a metric ton after peaking at $11,104.5, a gain of 30% since the start of the year.

“It’s a combination of short covering and funds jumping on the bandwagon. It’s a similar situation on COMEX,” a copper trader said, adding that a “fair amount” of the short covering was by “Chinese players”.

“Producer selling seems to have calmed the market a little,” he added.

COMEX copper prices also hit an all-time high of $5.1985 a lb, or $11,460 a ton, because of a short squeeze, where parties are forced to buy back their short positions at a loss or deliver physical copper to close them out.

Copper hits record high on China’s property support measure

“Sentiment in the copper market is bullish, reflected by the speculative buying seen in the market,” analysts at ING said. “Short-term fundamentals remain a concern, particularly when it comes to China.”

Weakness in China can be seen in inventories in warehouses monitored by the Shanghai Futures Exchange (ShFE), which stand at 290,376 tons, near the four-year highs hit last month, compared with 33,130 tons at the start of the year.

Over the longer term, however, expectations of stronger cyclical consumption, accelerating demand from the electric vehicle sector and new applications such as data centres for artificial intelligence are expected to underpin higher copper prices.

“It’s been difficult for investors to price future demand from the energy transition, lack of supply growth and artificial intelligence because of the risks from China property and high interest rates,” said Citi analyst Max Layton.

“That’s changed over the last few months, people are not as worried about the cyclical side…they see the bottoming in global PMIs (surveys of purchasing managers in manufacturing).”