Gold prices slipped for a second consecutive session on Thursday as the US dollar and Treasury yields edged higher ahead of key inflation data, which could offer further clarity on the Federal Reserve’s interest rate plan.

Spot gold was down 0.4% at $2,330.44 per ounce, as of 0311 GMT, after falling 1% on Wednesday. US gold futures fell 0.5% to $2,328.60.

The dollar strengthened 0.5%, making the greenback-priced bullion less attractive for other currency holders, while benchmark US 10-year bond yields lingered near the multi-week highs hit in the previous session.

“I think it’s a case of investors realising that the current high interest rate environment is likely to have an extended stay. And with the focus again turning to chasing US yields and dollar, some attention is taken away from gold this week,” said Tim Waterer, chief market analyst at KCM Trade.

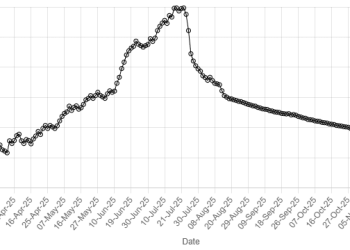

Bullion has dropped more than $100 since it hit a record high of $2,449.89 on May 20 as hawkish remarks from Fed officials and the last meeting minutes pointed to a prolonged path to 2% inflation target.

Gold falls as traders hunker down for US inflation print

While bullion is considered an inflation hedge, higher rates increase the opportunity cost of holding the non-yielding asset.

Traders are currently pricing in about a 59% chance of a rate cut by November, according to the CME FedWatch Tool.

The US core personal consumption expenditures (PCE) data, the Fed’s preferred measure for inflation, is due on Friday.

“I expect gold to probably hold onto the $2,300 handle during today’s session given the support levels, however any upside beat from the core PCE could see gold struggling to maintain that level,” Waterer said.

Global mining group BHP Group walked away from its $49 billion plan to take over rival Anglo American.

Spot silver fell 1.7% to $31.40, platinum was down 0.3% at $1,032.25 and palladium lost 2.1% to $944.75.