Copper futures dropped on Friday on a stronger dollar, although the London contract was poised for its first weekly gain in five as physical demand picked up after prices slumped to a two-month low.

Three-month copper on the London Metal Exchange was down 0.5% at $9,811.50 per metric ton, as of 0349 GMT.

Still, the contract has gained 0.8% on a weekly basis, and was on track to snap a fourth straight weekly loss.

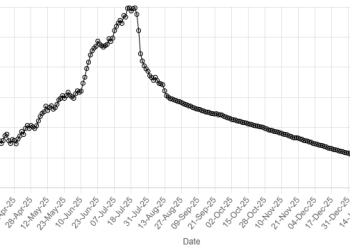

The US dollar pushed to a fresh eight-week top above 159 yen and clung close to a five-week peak to sterling, with the Federal Reserve’s patient approach to cutting interest rates contrasting with more dovish stances elsewhere.

A firmer dollar makes greenback-priced metals more expensive to holders of other currencies. Earlier in the week, LME copper hit $9,551 a ton, the lowest in two months, as persistently high stockpiles raised worries that demand for the metal was weak.

The drop in copper prices, however, encouraged more physical purchases this week, and in turn, provided a support around $9,500-$9,600 a ton, brokers said.

The most-traded July copper contract on the Shanghai Futures Exchange edged 0.1% higher to 79,540 yuan ($10,954.56) a ton.

Copper edges up on hopes of stronger demand, stockpiles cap gains

LME aluminium was nearly flat at $2,522.50 a ton, nickel fell 0.3% to $13,730, zinc declined 0.3% to $2,865, lead shed 0.5% to $2,205, and tin was flat at $33,086.

SHFE aluminium eased 0.2% to 20,505 yuan a ton, nickel dipped 0.2% to 134,900 yuan, lead dropped 1.5% to 18,760 yuan while zinc rose 0.2% to 23,860 yuan and tin jumped 0.9% to 273,490 yuan.

American Dollar Exchange Rate

American Dollar Exchange Rate